Increasing Frequency of Power Outages

The increasing frequency of power outages in Mexico has emerged as a critical driver for the backup power market. With reports indicating that power interruptions have risen by approximately 15% over the past few years, businesses and households are increasingly seeking reliable backup solutions. This trend is particularly pronounced in regions with aging infrastructure and high energy demand. The backup power market is responding to this need by offering a variety of solutions, including generators and battery storage systems. As consumers become more aware of the potential for outages, the demand for backup power solutions is likely to grow, prompting manufacturers to innovate and expand their offerings.

Rising Awareness of Energy Efficiency

There is a growing awareness of energy efficiency among consumers and businesses in Mexico, which is positively impacting the backup power market. As energy costs continue to rise, stakeholders are increasingly looking for solutions that not only provide backup power but also enhance overall energy efficiency. The backup power market is adapting by integrating advanced technologies such as smart inverters and energy management systems into their products. This shift towards energy-efficient solutions is likely to attract environmentally conscious consumers, further driving market growth. Additionally, government initiatives promoting energy efficiency could bolster this trend, encouraging more investments in backup power technologies.

Economic Growth and Industrial Expansion

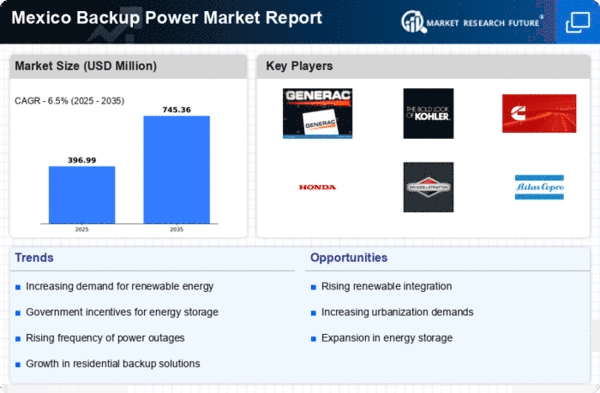

Mexico's robust economic growth and industrial expansion are significantly influencing the backup power market. The country's GDP growth rate has averaged around 2.5% annually, leading to increased energy consumption across various sectors. Industries such as manufacturing, telecommunications, and data centers are particularly reliant on uninterrupted power supply, driving the demand for backup power solutions. The backup power market is witnessing a surge in investments as companies seek to mitigate risks associated with power disruptions. This trend is expected to continue, with projections indicating that the market could reach a valuation of $1 billion by 2027, reflecting the growing importance of energy reliability in a competitive economic landscape.

Technological Innovations in Energy Storage

Technological innovations in energy storage are significantly transforming the backup power market in Mexico. Advances in battery technology, particularly lithium-ion batteries, have made backup power systems more efficient and cost-effective. The backup power market is witnessing a shift towards integrated solutions that combine energy generation and storage, allowing users to optimize their energy use. This trend is particularly relevant for commercial and industrial sectors, where the need for reliable power is paramount. As technology continues to evolve, the market is likely to see a proliferation of new products that cater to diverse consumer needs, enhancing the overall resilience of the energy infrastructure.

Government Incentives for Clean Energy Solutions

Government incentives aimed at promoting clean energy solutions are playing a pivotal role in shaping the backup power market. Mexico's commitment to reducing greenhouse gas emissions has led to various policies that encourage the adoption of renewable energy sources. These initiatives often include financial incentives for businesses and homeowners to invest in backup power systems that utilize solar or wind energy. The backup power market is likely to benefit from these policies, as they not only enhance the appeal of backup solutions but also align with national sustainability goals. As more consumers take advantage of these incentives, the market is expected to expand, fostering innovation and competition.