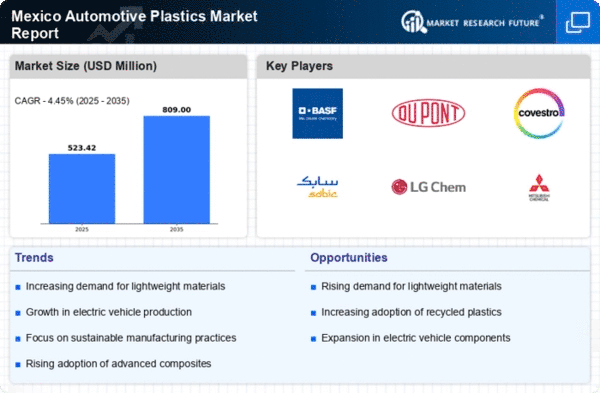

The automotive plastics market in Mexico is characterized by a dynamic competitive landscape, driven by increasing demand for lightweight materials that enhance fuel efficiency and reduce emissions. Key players such as BASF (DE), DuPont (US), and Covestro (DE) are strategically positioned to leverage innovation and sustainability in their operations. BASF (DE) focuses on developing advanced polymer solutions that cater to the evolving needs of the automotive sector, while DuPont (US) emphasizes its commitment to sustainable practices through the introduction of bio-based plastics. Covestro (DE) is actively pursuing partnerships to enhance its product offerings, particularly in the realm of circular economy initiatives, which collectively shape a competitive environment that prioritizes innovation and environmental responsibility.In terms of business tactics, companies are increasingly localizing manufacturing to optimize supply chains and reduce costs. The market appears moderately fragmented, with several players vying for market share. However, the collective influence of major companies like SABIC (SA) and LG Chem (KR) is notable, as they implement strategies that enhance their operational efficiencies and market reach. This competitive structure fosters an environment where collaboration and strategic partnerships are essential for maintaining a competitive edge.

In October SABIC (SA) announced a significant investment in a new production facility in Mexico aimed at increasing its capacity for high-performance automotive plastics. This strategic move is likely to enhance SABIC's ability to meet the growing demand for lightweight materials in the automotive sector, positioning the company favorably against its competitors. The investment underscores the importance of local production capabilities in responding to market needs swiftly and effectively.

In September LG Chem (KR) launched a new line of eco-friendly automotive plastics designed to reduce environmental impact while maintaining performance standards. This initiative reflects a broader trend towards sustainability within the industry, as companies seek to align their product offerings with consumer preferences for greener alternatives. The introduction of these materials may provide LG Chem with a competitive advantage in a market increasingly focused on environmental considerations.

In August DuPont (US) entered into a strategic partnership with a leading automotive manufacturer to co-develop advanced composite materials for electric vehicles. This collaboration is indicative of the growing trend towards electrification in the automotive sector, as manufacturers seek to enhance vehicle performance while reducing weight. Such partnerships are likely to play a crucial role in shaping the future of automotive plastics, as they enable companies to leverage each other's strengths and accelerate innovation.

As of November current competitive trends in the automotive plastics market include a pronounced focus on digitalization, sustainability, and the integration of artificial intelligence in manufacturing processes. Strategic alliances are increasingly shaping the landscape, allowing companies to pool resources and expertise to drive innovation. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and adapt to changing market demands.