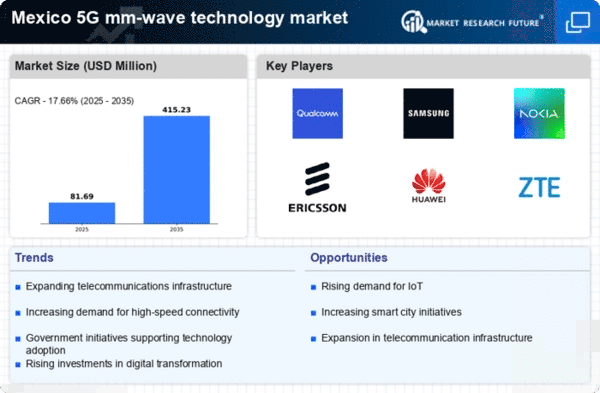

Growth of IoT and Smart Devices

The proliferation of Internet of Things (IoT) devices in Mexico serves as a catalyst for the 5g mm-wave-technology market. With an estimated 30 million IoT devices expected to be connected by 2025, the demand for high-speed, low-latency connectivity is paramount. 5g mm-wave technology is particularly well-suited for supporting the vast number of devices that require real-time data transmission. This growth in IoT applications, ranging from smart homes to industrial automation, necessitates robust network capabilities, thereby driving investments in 5g mm-wave infrastructure. As businesses and consumers increasingly adopt smart devices, the 5g mm-wave-technology market is poised for substantial growth, reflecting the changing landscape of connectivity in Mexico.

Government Initiatives and Funding

Government initiatives aimed at enhancing digital infrastructure in Mexico significantly influence the 5g mm-wave-technology market. The Mexican government has allocated substantial funding to improve telecommunications networks, with a focus on expanding 5g capabilities. In 2025, it is projected that government investments in digital infrastructure will reach $1 billion, aimed at fostering innovation and economic growth. These initiatives not only support the deployment of 5g mm-wave technology but also encourage private sector participation, creating a conducive environment for market expansion. As a result, the collaboration between government and industry stakeholders is likely to accelerate the adoption of 5g mm-wave technology across various sectors, including healthcare, education, and transportation.

Competitive Landscape and Market Entry

The competitive landscape in Mexico's telecommunications sector is evolving, with new entrants and established players vying for market share in the 5g mm-wave-technology market. This competition is likely to spur innovation and drive down costs, making advanced technologies more accessible to consumers and businesses alike. In 2025, it is anticipated that the number of telecommunications providers offering 5g services will increase by 25%, fostering a dynamic market environment. As companies strive to differentiate their offerings, the introduction of new services and pricing models may further stimulate demand for 5g mm-wave technology. This competitive pressure is expected to enhance the overall growth trajectory of the market, benefiting end-users through improved service quality and affordability.

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity in Mexico is a primary driver for the 5g mm-wave-technology market. As businesses and consumers seek faster internet speeds for various applications, the need for advanced telecommunications infrastructure becomes evident. In 2025, it is estimated that the demand for mobile data will grow by approximately 50%, necessitating the deployment of 5g mm-wave technology to meet these requirements. This technology offers enhanced bandwidth and lower latency, making it suitable for applications such as augmented reality and smart cities. Consequently, telecommunications providers are investing heavily in upgrading their networks to support this demand, thereby propelling the growth of the 5g mm-wave-technology market in Mexico.

Enhanced User Experience and Application Development

The potential for enhanced user experiences through the development of new applications is a significant driver for the 5g mm-wave-technology market. As developers create innovative applications that leverage the capabilities of 5g mm-wave technology, users are likely to experience improved performance in areas such as gaming, streaming, and virtual reality. In 2025, it is projected that the number of applications utilizing 5g mm-wave technology will increase by 40%, reflecting the growing interest in high-bandwidth applications. This surge in application development not only attracts consumers but also encourages businesses to adopt 5g solutions to remain competitive. Consequently, the focus on user experience and application innovation is expected to play a crucial role in shaping the future of the 5g mm-wave-technology market in Mexico.