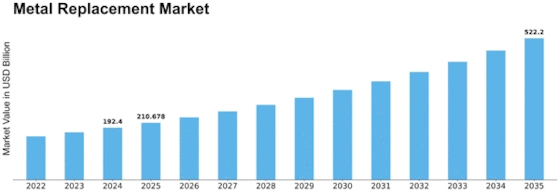

Metal Replacement Size

Metal Replacement Market Growth Projections and Opportunities

The Metal Replacement Market likes many other commodities market is quite sensitive to a number of issues that help realize its potential or put the brakes on potentialities. A growing need for lightweight materials that are found in many leading industries is one of the fundamental factors. While industries are powering their efforts to improve the efficiency of fuel and the overall weight in applications, like, the automotive and aerospace, the tendency to be using composite materials, polymers, and advanced ceramics as metal to be removed is rising.

In addition, the market is subject to the need of the non-corrosive materials due to the stress. Industries now being to be aware of traditional metals' corrosion, thus go after non-traditional materials with much better durability. Sector like construction is specially one where metal replacement materials being used so much because of their ability to withstand corrosion or harsh environmental conditions.

Metal Replacement industry size stood at approx. USD 160.5 Billion in year 2022. Growth of chemical industry market, Metal replacements, is predicted to rise from USD 175.7 billion in 2023 to USD 363.2 billion by 2032 with a compound annual growth rate (CAGR) of 9.50%.

Moreover, the National Replacement Market is figuratively designed by the rising interest on environment protection and eco-sustainability. Metals like aluminum, magnesium, as well as the new generation of polymers are gaining popularity as replacements for conventional metals because of preserving the environment and recycling process form. Such shift complements worldwide development of green products and processes (ecofriendliness); the expanding metal replacement industry takes advantage of the situation.

Besides, the constant introduction of innovative and technologically advanced materials is another major factor that is significantly affecting the current market. Researchers and craft makers continue to spearhead the processes of extraction and synthesis of materials that boast of such high strengths, heat resistance, and general performances compared to common metals. Additionally, this never-ending technical upgrade offers industries a more various choice of substituting metal with different materials, depending on their needs.

On top of that, the price factor matters so much that it can be considered as the main stimuli of the Metal Replacement Market. The high prices associated with high-tech materials are often overcome by the long-term benefits like cost savings due to low maintenance or longer equipment lifespan which, in turn, lead to quicker ROI. When companies target ways for cutting their costs and simultaneously reducing expenses for operational activities, economic applicability of synthesized biomass materials becomes a critical issue which is at issue for their adoption.

Leave a Comment