Industrial Growth

The resurgence of industrial activities across various sectors, including manufacturing and energy, significantly influences the Metal Grating Market. As industries expand, the need for efficient and safe work environments becomes paramount. Metal grating provides essential solutions for flooring, walkways, and drainage systems, ensuring safety and operational efficiency. Recent statistics suggest that the manufacturing sector is expected to witness a growth rate of around 4% annually, which could lead to increased investments in safety equipment and materials. This industrial growth not only enhances the demand for metal grating but also encourages innovation in product design and functionality within the Metal Grating Market.

Environmental Regulations

The increasing emphasis on environmental regulations and sustainability practices is reshaping the Metal Grating Market. As industries strive to comply with stringent environmental standards, the demand for eco-friendly materials rises. Metal grating, often made from recyclable materials, aligns well with these sustainability initiatives. Furthermore, the implementation of regulations aimed at reducing waste and promoting recycling is likely to drive the adoption of metal grating solutions. Market data indicates that the eco-friendly materials segment is expected to grow significantly, potentially reaching a market share of 30% by 2027. This shift towards sustainable practices presents opportunities for manufacturers to innovate and cater to the evolving preferences of consumers within the Metal Grating Market.

Technological Innovations

Technological advancements in manufacturing processes and materials are poised to impact the Metal Grating Market positively. Innovations such as improved welding techniques and the introduction of lightweight yet durable materials enhance the performance and application range of metal grating products. These advancements not only improve product quality but also reduce production costs, making metal grating more accessible to a broader range of industries. Recent trends indicate that the adoption of advanced manufacturing technologies could lead to a 15% reduction in production costs over the next five years. This potential for cost savings, coupled with enhanced product offerings, positions the Metal Grating Market for substantial growth as industries seek efficient and cost-effective solutions.

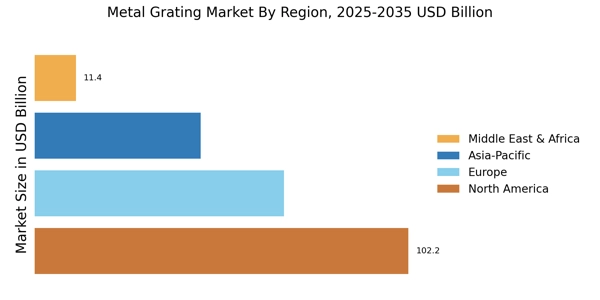

Infrastructure Development

The ongoing expansion of infrastructure projects across various sectors appears to be a primary driver for the Metal Grating Market. Governments and private entities are investing heavily in the construction of roads, bridges, and public facilities, which necessitates durable and reliable materials. Metal grating, known for its strength and longevity, is increasingly utilized in these applications. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years, further fueling demand for metal grating solutions. This trend indicates a robust market potential for manufacturers and suppliers within the Metal Grating Market, as they align their offerings with the needs of large-scale infrastructure projects.

Safety Standards and Compliance

The increasing focus on safety standards and compliance regulations across various industries is a critical driver for the Metal Grating Market. As organizations prioritize worker safety, the demand for reliable and compliant materials rises. Metal grating is often utilized in environments where slip resistance and load-bearing capabilities are essential, such as in industrial plants and commercial facilities. Recent data suggests that the safety equipment market is projected to grow at a rate of 6% annually, indicating a strong correlation with the demand for metal grating solutions. This heightened awareness of safety standards not only drives sales but also encourages manufacturers to innovate and enhance their product offerings within the Metal Grating Market.