Metal Fiber Size

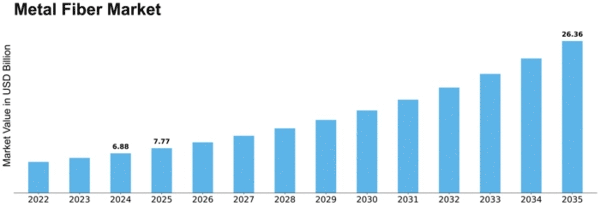

Metal Fiber Market Growth Projections and Opportunities

Metal Fiber Market is projected to be worth USD 4.5 billion by 2030, registering a CAGR of 9.30% during the forecast period (2022-2030).

Industrial Applications: Metal fibers find extensive use in industrial applications such as filtration, insulation, reinforcement, and conductive materials. The versatility and unique properties of metal fibers, including high strength, conductivity, and heat resistance, make them indispensable in industries such as aerospace, automotive, electronics, and construction, influencing market demand.

Technological Advancements: Continuous advancements in manufacturing processes, material science, and fiber production technologies drive innovation in the metal fiber market. Adoption of advanced techniques such as electrospinning, melt spinning, and vapor deposition enhances fiber quality, consistency, and performance, shaping market trends and product development.

Demand from Aerospace and Defense Industries: The aerospace and defense industries are major consumers of metal fibers for applications such as composites, thermal management, electromagnetic shielding, and ballistic protection. As these industries seek lightweight, high-performance materials for aircraft, spacecraft, and military equipment, the demand for metal fibers continues to grow, influencing market dynamics.

Automotive Industry Requirements: Metal fibers are used in automotive applications such as catalytic converters, brake pads, gaskets, and acoustic insulation. As automotive manufacturers strive to improve vehicle performance, fuel efficiency, and safety, the demand for metal fibers for lightweighting, noise reduction, and thermal management purposes increases, driving market growth.

Healthcare Sector Demand: Metal fibers find applications in the healthcare sector for medical textiles, wound dressings, surgical implants, and diagnostic devices. The biocompatibility, antimicrobial properties, and durability of metal fibers make them suitable for medical applications, influencing market demand and product innovation in the healthcare sector.

Environmental Regulations and Sustainability: Adherence to environmental regulations and sustainability standards is essential for manufacturers of metal fibers to ensure responsible production practices. Compliance with regulations related to waste management, energy efficiency, and emissions reduction influences market competitiveness and customer preferences for eco-friendly materials.

Consumer Electronics Market Trends: Metal fibers are used in consumer electronics for applications such as electromagnetic interference (EMI) shielding, flexible circuits, and touchscreens. As consumer electronics devices become smaller, lighter, and more advanced, the demand for metal fibers for electromagnetic compatibility and functional applications increases, driving market demand.

Cost and Pricing Dynamics: The cost-effectiveness of metal fibers compared to alternative materials influences market adoption and pricing strategies. Factors such as raw material costs, production efficiency, and economies of scale impact pricing dynamics and market competitiveness, influencing purchasing decisions and market trends.

Global Economic Conditions: The overall economic conditions, including GDP growth, industrial output, and consumer spending patterns, influence the demand for metal fibers across different regions. Economic stability, infrastructure development, and manufacturing activity impact market demand, investment decisions, and market expansion opportunities within the metal fiber market.

Market Competition and Innovation: The competitive landscape within the metal fiber market, characterized by the presence of key players, technological advancements, and market share distribution, influences market dynamics. Manufacturers need to innovate, differentiate their offerings, and collaborate with industry partners to address evolving customer needs and gain a competitive edge in the market.

Leave a Comment