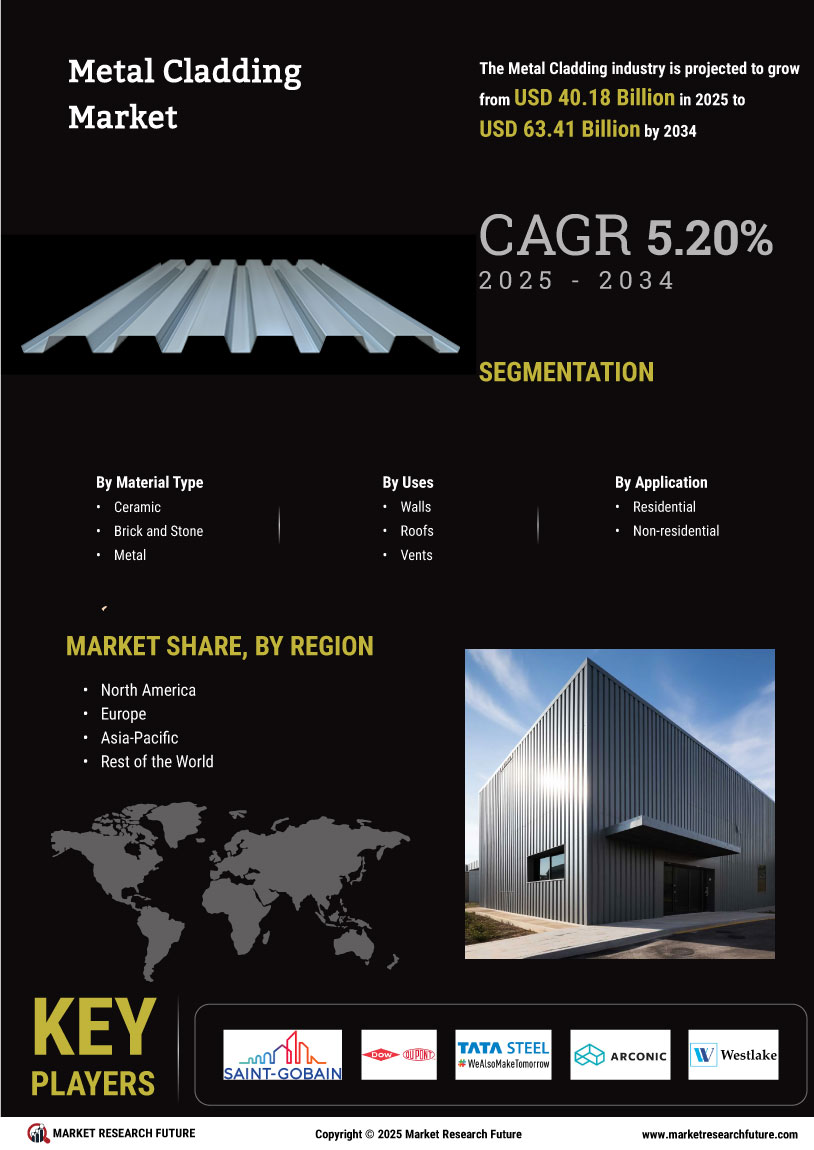

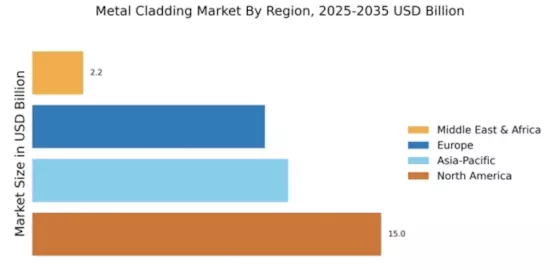

Market Growth Projections

The Global Metal Cladding Market Industry is projected to experience substantial growth over the next decade. With an estimated market value of 38.2 USD Billion in 2024, the industry is expected to expand to 66.7 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 5.2% from 2025 to 2035, driven by various factors including increased construction activities, sustainability trends, and technological advancements. These projections indicate a robust future for the metal cladding sector, highlighting its importance in modern construction practices.

Growing Construction Activities

The Global Metal Cladding Market Industry is experiencing a surge due to increasing construction activities worldwide. As urbanization accelerates, the demand for residential and commercial buildings rises, leading to a greater need for durable and aesthetically pleasing materials. Metal cladding Market, known for its longevity and low maintenance, is becoming a preferred choice among architects and builders. In 2024, the market is projected to reach 38.2 USD Billion, reflecting the industry's robust growth. This trend is likely to continue as more countries invest in infrastructure development, further driving the demand for metal cladding solutions.

Rising Demand for Aesthetic Appeal

The aesthetic appeal of metal cladding is becoming a crucial factor in the Global Metal Cladding Market Industry. Architects and designers are increasingly incorporating metal cladding into their projects to achieve modern and visually striking facades. The versatility of metal materials allows for various finishes and colors, enabling creative expression in building design. As consumer preferences shift towards unique and attractive buildings, the demand for metal cladding is expected to rise. This trend aligns with the overall growth of the construction sector, further solidifying the market's position in the coming years.

Sustainability and Energy Efficiency

Sustainability concerns are increasingly influencing the Global Metal Cladding Market Industry. Metal cladding Market materials, particularly those that are recyclable and energy-efficient, align with the growing emphasis on green building practices. As regulations tighten around energy consumption in buildings, architects and builders are turning to metal cladding for its thermal efficiency and potential to reduce energy costs. This shift not only meets regulatory requirements but also appeals to environmentally conscious consumers. The market's growth trajectory suggests that by 2035, it could reach 66.7 USD Billion, driven by the demand for sustainable construction materials.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are significantly impacting the Global Metal Cladding Market Industry. Innovations such as improved coating techniques and automated production lines enhance the quality and efficiency of metal cladding products. These advancements allow for greater customization and design flexibility, catering to diverse architectural needs. As manufacturers adopt cutting-edge technologies, the market is likely to witness increased competition and product differentiation. This dynamic environment may contribute to a compound annual growth rate of 5.2% from 2025 to 2035, indicating a promising future for the industry.

Regulatory Support for Infrastructure Development

Regulatory support for infrastructure development is playing a pivotal role in the Global Metal Cladding Market Industry. Governments worldwide are implementing policies that encourage investment in infrastructure, including housing, commercial spaces, and public facilities. These initiatives often prioritize the use of durable and sustainable materials, such as metal cladding, which meets safety and environmental standards. As a result, the market is poised for growth, with projections indicating a significant increase in demand. This supportive regulatory environment is likely to foster innovation and investment in metal cladding solutions, enhancing the industry's overall landscape.