Growing Demand for Preventive Healthcare

The shift towards preventive healthcare is emerging as a crucial driver for the Metabolic Testing Market. As individuals become more health-conscious, there is a growing emphasis on early detection of metabolic issues to prevent chronic diseases. This trend is reflected in the increasing number of health screenings and wellness programs offered by employers and healthcare providers.

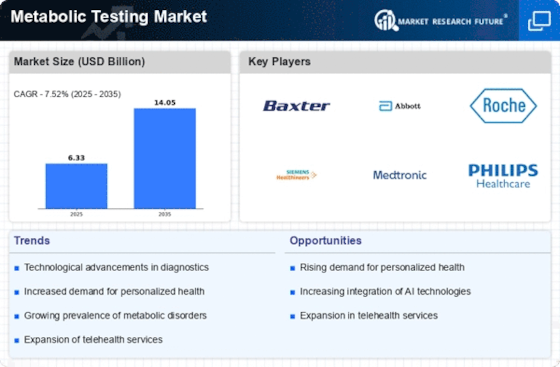

According to industry reports, the preventive healthcare market is projected to grow significantly, which will likely boost the demand for metabolic testing services. By identifying metabolic risks early, individuals can take proactive measures to improve their health outcomes. Thus, the Metabolic Testing Market stands to benefit from this paradigm shift towards preventive care.

Rising Prevalence of Metabolic Disorders

The increasing incidence of metabolic disorders, such as obesity and diabetes, appears to be a primary driver for the Metabolic Testing Market. According to recent data, the prevalence of obesity has reached alarming levels, affecting millions worldwide. This trend necessitates effective metabolic testing to monitor and manage these conditions. As healthcare providers seek to offer personalized treatment plans, the demand for metabolic testing services is likely to rise.

Furthermore, the World Health Organization has indicated that metabolic disorders are among the leading causes of morbidity and mortality, which underscores the urgency for accurate testing solutions. Consequently, the Metabolic Testing Market is poised for growth as healthcare systems prioritize early detection and intervention strategies.

Increased Investment in Health Technology

The surge in investment in health technology is poised to impact the Metabolic Testing Market positively. Venture capital and government funding are increasingly directed towards innovative health solutions, including metabolic testing technologies. This influx of capital is facilitating research and development efforts aimed at enhancing testing accuracy and accessibility.

Moreover, partnerships between technology firms and healthcare organizations are fostering the creation of advanced metabolic testing solutions. As these investments continue to grow, they are likely to drive the expansion of the Metabolic Testing Market, making cutting-edge testing options more widely available to healthcare providers and patients alike.

Technological Innovations in Testing Methods

Technological advancements in metabolic testing methodologies are significantly influencing the Metabolic Testing Market. Innovations such as non-invasive testing techniques and advanced biomarker analysis are enhancing the accuracy and efficiency of metabolic assessments. For instance, the development of portable metabolic analyzers allows for real-time monitoring of metabolic rates, which could potentially transform patient care.

The integration of artificial intelligence in data analysis further streamlines the interpretation of metabolic test results, making it easier for healthcare professionals to devise tailored treatment plans. As these technologies continue to evolve, they are expected to drive the adoption of metabolic testing services, thereby expanding the Metabolic Testing Market.

Integration of Metabolic Testing in Clinical Practice

The integration of metabolic testing into routine clinical practice is likely to enhance the Metabolic Testing Market. Healthcare providers are increasingly recognizing the value of metabolic assessments in managing patient health. This integration facilitates a more comprehensive approach to patient care, allowing for better monitoring of metabolic health and the effectiveness of interventions.

As clinical guidelines evolve to include metabolic testing as a standard practice, the demand for these services is expected to rise. Additionally, the collaboration between healthcare professionals and metabolic testing laboratories is fostering a more streamlined process for patient referrals and testing. This synergy is anticipated to propel the growth of the Metabolic Testing Market.