Market Analysis

In-depth Analysis of MENA Solar Energy Market Industry Landscape

The MENA (Middle East and North Africa) region is experiencing a significant shift in its energy landscape, particularly in the realm of solar power. Market dynamics in the MENA solar energy sector are characterized by a combination of factors, including policy initiatives, technological advancements, investment trends, and regional cooperation. Governments across the region are increasingly recognizing the importance of renewable energy sources, such as solar, in diversifying their energy mix, reducing dependency on fossil fuels, and mitigating climate change.

One of the key drivers shaping the MENA solar energy market is supportive government policies and initiatives. Many countries in the region have introduced ambitious renewable energy targets and incentive programs to promote the adoption of solar power. For example, feed-in tariffs, tax incentives, and subsidies are commonly used mechanisms to attract investment and stimulate growth in the solar sector. These policies create a favorable environment for both domestic and international investors, driving market expansion and innovation.

Technological advancements play a crucial role in enhancing the competitiveness of solar energy in the MENA region. The declining cost of solar photovoltaic (PV) technology, coupled with improvements in efficiency and reliability, has made solar power increasingly affordable and accessible. Innovations in energy storage solutions, such as battery storage, are also contributing to the integration of solar energy into the grid, addressing intermittency challenges and enabling greater flexibility in energy supply.

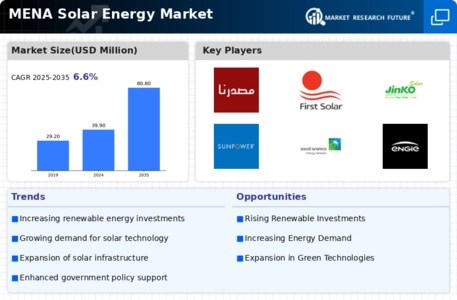

Investment trends reflect growing confidence in the MENA solar energy market as a lucrative investment opportunity. Private sector investment, including from both local and international firms, is pouring into utility-scale solar projects, rooftop solar installations, and solar manufacturing facilities. Venture capital and private equity funding are supporting startups and innovative ventures in the solar space, driving technological innovation and market disruption.

Regional cooperation initiatives are fostering collaboration among MENA countries to leverage their collective resources and expertise in advancing solar energy development. Platforms like the Arab Renewable Energy Commission and the Gulf Cooperation Council are facilitating knowledge sharing, capacity building, and joint investment projects in solar power. By pooling their resources and coordinating their efforts, countries in the region can accelerate the transition to a more sustainable and resilient energy system.

Challenges remain in realizing the full potential of the MENA solar energy market. Despite significant progress, regulatory barriers, bureaucratic hurdles, and political instability in some countries continue to hinder investment and project development. Grid infrastructure constraints and limited access to financing also pose challenges to the scalability of solar power deployment. Addressing these challenges will require continued collaboration between governments, businesses, and other stakeholders to create an enabling environment for solar energy investment and deployment.

The MENA solar energy market is experiencing dynamic growth driven by supportive policies, technological advancements, investment trends, and regional cooperation. As countries in the region strive to diversify their energy sources and transition to a more sustainable energy future, solar power is poised to play a central role in meeting growing electricity demand, reducing greenhouse gas emissions, and promoting economic development. With the right policies, investments, and collaborative efforts, the MENA region can unlock the full potential of its abundant solar resources and emerge as a global leader in renewable energy.

Leave a Comment