Top Industry Leaders in the MENA Solar Energy Market

*Disclaimer: List of key companies in no particular order

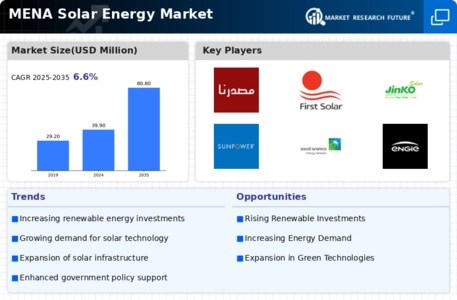

Top listed companies in the MENA Solar Energy industry are:

ACWA Power, Masdar (Abu Dhabi Future Energy Company), First Solar, JinkoSolar, SunPower, DEWA (Dubai Electricity and Water Authority), Saudi Aramco, Scatec Solar, ACWAPower and Engie

The MENA region, bathed in abundant sunshine and driven by ambitious renewable energy targets, is witnessing a remarkable solar energy surge. This translates to a fiercely competitive landscape with diverse players battling for market share. To thrive in this dynamic space, understanding the key strategies, emerging trends, and crucial factors influencing market share is imperative.

Key Player Strategies:

- Government-backed giants: Regional power players like ACWA Power (Saudi Arabia) and Masdar (UAE) leverage their financial muscle and government connections to secure large-scale projects and contracts. They also actively invest in green hydrogen initiatives, positioning themselves for the future energy mix.

- International developers: Global leaders like Scatec Solar and JinkoSolar bring their technological expertise and experience to the table, often entering joint ventures with local players to navigate cultural nuances and regulatory hurdles.

- Local champions: Enerwhere and Yellow Door Energy are carving a niche in distributed solar solutions, catering to residential and commercial rooftops. Their flexible financing models and innovative approaches like pay-as-you-go are crucial for market penetration.

- Technology disruptors: Start-ups like Bayanat Clean Energy are introducing AI-powered energy management systems and cloud-based analytics, optimizing efficiency and maximizing output. This data-driven approach holds immense potential for cost reduction and grid integration.

Factors for Market Share Analysis:

- Project portfolio and execution capabilities: A robust pipeline of secured projects and the ability to deliver them on time and within budget are critical. Large-scale project wins can significantly shift market share dynamics.

- Technology leadership and innovation: Offering cutting-edge solar technologies, like high-efficiency modules and advanced tracking systems, provides a competitive edge. Companies actively involved in R&D and pilot projects gain favor.

- Financial strength and risk management: Access to capital, competitive financing solutions, and efficient risk management strategies are crucial for securing large-scale investments and weathering market fluctuations.

- Local partnerships and understanding: Navigating the complex regional regulations and building strong relationships with local stakeholders are essential for successful project execution and market access.

New and Emerging Trends:

- Shift towards distributed solar: Rooftop installations and microgrids are gaining traction, driven by declining costs and government incentives. This decentralization trend opens up new opportunities for smaller players and innovative business models.

- Focus on storage and grid integration: As solar penetration increases, grid integration and energy storage solutions become critical for managing intermittency and ensuring grid stability. Companies offering integrated solutions will gain an edge.

- Green hydrogen as the next frontier: With abundant sunshine and vast desert lands, the MENA region has the potential to become a green hydrogen hub. Companies investing in hydrogen production and utilization will be well-positioned for the future energy landscape.

- Sustainability beyond generation: The focus is shifting towards the entire solar value chain, including responsible waste management, circular economy practices, and community engagement. Players demonstrating a commitment to environmental and social sustainability will gain favor.

The MENA solar energy market is fiercely competitive, characterized by diverse players, evolving strategies, and new trends. While government-backed giants and international developers currently hold a significant share, local champions and technology disruptors are rapidly gaining ground. The ability to adapt to the changing landscape, embrace innovation, and demonstrate a commitment to sustainability will be key for success in this dynamic market.

Latest Company Updates:

Masdar (Abu Dhabi Future Energy Company):

- October 2023: Masdar announced a joint venture with Shell to develop a 5 GW green hydrogen project in Oman. (Source: Bloomberg, October 25, 2023)

First Solar:

- December 2023: First Solar secured a contract to supply 1.6 GW of its Series 7 module technology for a project in the Middle East. (Source: First Solar press release, December 12, 2023)

JinkoSolar:

- December 2023: JinkoSolar signed a contract to supply 1 GW of its Tiger Neo N-type modules for a project in the UAE. (Source: JinkoSolar press release, December 27, 2023)

SunPower:

- December 2023: SunPower announced a partnership with DEWA to develop a 1 GW solar rooftop project in Dubai. (Source: SunPower press release, December 15, 2023)

Scatec Solar:

- December 2023: Scatec Solar secured a contract to develop a 100 MW solar PV project in Jordan. (Source: Scatec Solar press release, December 14, 2023)