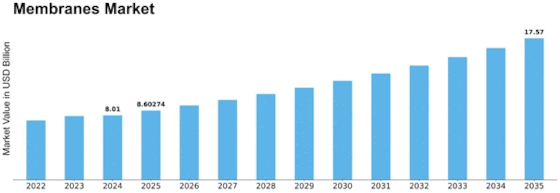

Membranes Size

Membranes Market Growth Projections and Opportunities

The membranes market is dependent upon the impact of various variables that on the whole add to its extension, mechanical movements, and execution in different areas. Industry members actually should appreciate these market factors to successfully explore snags, hold onto worthwhile conditions, and adjust to creating patterns. Absence of Water and Treatment Necessities: Expanding overall water shortage concerns impel the requirement for membranes in the field of water remediation. Film advances, including reverse assimilation and ultrafiltration, are vital in tending to the growing worries in regard to water quality and shortage by guaranteeing the arrangement of spotless and consumable water. Treatment of Wastewater and Guidelines: The interest in films in wastewater treatment is driven by the basic for mindful wastewater the executives and tough ecological guidelines. As well as advancing maintainable water reuse and really treating modern and metropolitan profluent, membrane processes additionally stick to administrative prerequisites. Drawn out Extension of Drug Applications: The interest in membranes is impacted by the drug business' outstanding development, explicitly in applications like filtration and detachment. By ensuring the quality and immaculateness of drug items, membrane innovations are irreplaceable to the drug producing process. The Biotechnology Area Is Extending: The powerful biotechnology industry is profoundly reliant upon membrane innovations for a huge number of purposes, like the detachment and filtration of proteins. Biotechnology layer request is affected by the necessity for adaptable and viable partition techniques in the development of biopharmaceuticals. Mechanical Progressions in Desalination: The expanded conspicuousness of desalination as an answer for freshwater deficiencies has prompted a flood popular for membrane, explicitly those used backward assimilation desalination. Desalination innovation and film material progressions add to the development of the market by fulfilling the overall interest for freshwater creation. Expanding Accentuation on the Handling of Food and Refreshments: Film request is driven by the food and refreshment industry's accentuation on quality, wellbeing, and handling effectiveness. The market for membrane filtration is extending because of its broad application in different cycles, including drink explanation, dairy handling, and food fixing focus. Effectiveness in Energy Partition of Gas: Gas partition strategies that are energy effective, like the development of nitrogen and the purging of petroleum gas, depend vigorously on membranes. The energy business’s appeal for layer advancements comes from their ability to offer affordable and biologically practical gas partition arrangements. Expanding Natural Maintainability Mindfulness: As natural maintainability cognizance increments, market elements are affected. By goodness of their naturally positive attributes rather than regular partition innovations, membranes are acquiring notoriety as businesses endeavor to execute maintainable methodologies that moderate their biological effect. Advancements in Film Material Innovation: Constant mechanical advancement in membranes materials is a critical consideration for the improvement of execution and proficiency. Material progressions, for example, the production of nanocomposite membranes and superior execution polymers, expand the general functionalities and upper hand of layer advances.

Leave a Comment