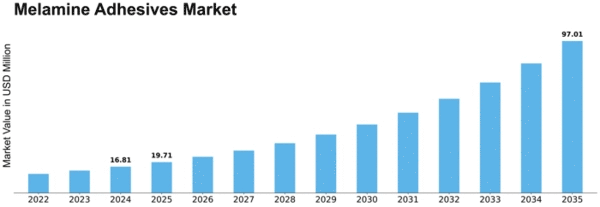

Melamine Adhesives Size

Melamine Adhesives Market Growth Projections and Opportunities

The Melamine-Based Adhesives Market is affected by several variables. These just are market characteristics that businesses and stakeholders must understand to get ahead in the sector. Construction and furniture expansions stimulate the Melamine-Based Adhesives Market. These are commonly used to attach wood panels, laminates and furniture parts. Because building is on the rise and people want beautiful furnishings, therefore the industry expands. Performance, durability and resistance to heat as well as moisture make melamine-based adhesives much in demand. Because industries are demanding tougher, more resilient adhesives. This is crucial in environments where adhesives are harsh. Melamine-based adhesives are playing an increasingly important part in the automotive industry. This type of adhesives is used for interior components such as laminated panels and ornamental surfaces. Improving interior aesthetics and functionality, melamine-based adhesives are much needed by the car industry. Melamine-based adhesives are versatile. They are used in construction, furniture, automobiles and textiles. This adaptability makes adhesives important in almost every industry, and it endows the market with stability and durability. The current focus on sustainability means that green adhesives are in hot demand. This trend is supported by melamine-based adhesives, which emit low amounts of formaldehyde and are environmentally acceptable. It is the rising demand for environment-friendly adhesives that benefit this market. R & D in adhesive technologies define the Melamine-Based Adhesives Market. Improvements in adhesive include higher bonding strength, faster cure time and better exterior resistance. Ever-improving developments make the market more competitive and acceptable to industry. Regulatory and safety compliance are important factors in the market. Safety and environmental requirements must be met by makers of melamine-based glue in accordance with industry laws. Regulatory compliance adds to market acceptance and industrial development of these adhesives. The affordability of melamine-based adhesives dictates market dynamics. When economic conditions change, industries choose adhesives that strike a balance between performance and cost. The economics and affordability of these adhesives have an impact on their adoption throughout various industries. Dynamics of the supply chain and globalization influence Melamine-Based Adhesives Market. The stability of the global manufacturing market depends on availability of raw materials, distribution networks and geopolitics. The material flow Accordingly, companies must manage supply chain complexity. Competition in the melamine-based adhesives market revolves around major players and industry concentration. Through merger, acquisition and strategic alliances companies strengthen their market positions. These competitive dynamics affect product development, price and market trajectory.

Leave a Comment