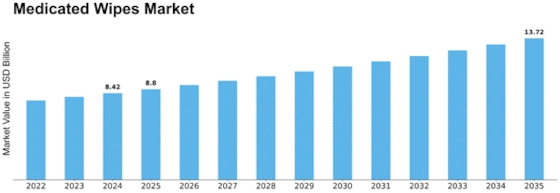

Medicated Wipes Size

Medicated Wipes Market Growth Projections and Opportunities

Medicated wipes are handy for soothing discomfort or irritation, and both adults and children use them. The global market for these wipes is expanding, thanks to more people worldwide dealing with acne and other skin issues. Additionally, there's a rising awareness about personal hygiene contributing to this growth. The use of biodegradable materials for making these wipes is also on the rise, which presents promising opportunities for the market in the future. However, worries about rashes and allergies could slow down the market's growth in the coming years.

Let's break down why medicated wipes are becoming increasingly popular. These wipes are designed to provide relief when you're feeling uncomfortable or irritated, making them useful for various situations. Both adults and children use them, reflecting their broad appeal and practicality for different age groups.

Now, why is the global market for medicated wipes growing? One significant reason is the increasing prevalence of skin issues like acne around the world. More people are dealing with these conditions, and as a result, there's a growing demand for products that can help alleviate discomfort and irritation. Medicated wipes fit the bill perfectly, contributing to the expansion of the market.

Another factor driving the growth is the rising awareness of personal hygiene. People are becoming more conscious of the importance of maintaining good hygiene practices. Using medicated wipes is seen as a convenient and effective way to address personal care needs, further fueling the market's development.

The use of biodegradable materials in making these wipes is a noteworthy trend that's gaining traction. Biodegradable materials break down naturally over time, causing less harm to the environment. This approach aligns with the increasing global focus on sustainability. As more people and companies prioritize eco-friendly options, the use of biodegradable materials in medicated wipes provides a promising avenue for future growth in the market.

However, it's essential to consider potential challenges. Despite the positive aspects, concerns related to rashes and allergies could pose obstacles to the market's growth in the forecast period. Some individuals might be sensitive to certain ingredients in these wipes, leading to skin reactions. Addressing these concerns and ensuring the safety of users will be crucial for sustaining the market's upward trajectory.

The medicated wipes are becoming increasingly popular globally due to their effectiveness in providing relief from discomfort and irritation. The market is expanding because of the growing prevalence of skin issues like acne, heightened awareness of personal hygiene, and the adoption of biodegradable materials for sustainable production. While there are promising opportunities for growth, it's essential to navigate challenges related to potential skin reactions to ensure the continued success of the market in the future.

Leave a Comment