Increased Focus on Innovation

Innovation remains a driving force within the Medical Device Analytical Testing Outsourcing Market. As companies strive to develop cutting-edge medical devices, the need for comprehensive analytical testing becomes paramount. The introduction of novel materials and technologies necessitates rigorous testing to validate performance and safety. In 2025, the market for innovative medical devices is anticipated to grow significantly, with a projected value exceeding USD 10 billion. This surge in innovation compels manufacturers to outsource analytical testing to specialized firms that can provide the necessary expertise and resources. By doing so, companies can expedite their product development timelines while ensuring compliance with evolving regulatory standards.

Globalization of Supply Chains

The Medical Device Analytical Testing Outsourcing Market is increasingly influenced by the globalization of supply chains. As manufacturers expand their operations across borders, the complexity of regulatory requirements also escalates. This trend necessitates the outsourcing of analytical testing to firms that possess a deep understanding of local regulations and standards. In 2025, it is estimated that approximately 40% of medical device manufacturers will rely on outsourced testing services to navigate these complexities. By leveraging the expertise of specialized laboratories, companies can ensure compliance with diverse regulatory frameworks while focusing on their core competencies. This strategic approach not only mitigates risks but also enhances operational efficiency.

Growing Emphasis on Cost Management

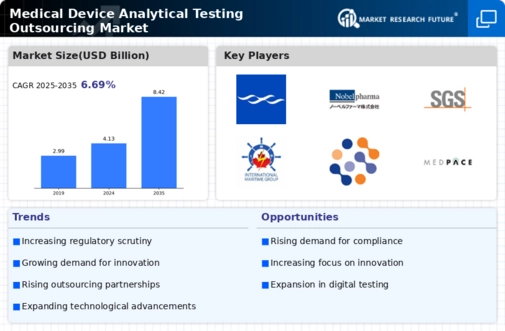

Cost management is a critical driver within the Medical Device Analytical Testing Outsourcing Market. As competition intensifies, manufacturers are increasingly seeking ways to reduce operational costs without compromising quality. Outsourcing analytical testing services presents a viable solution, allowing companies to access specialized expertise and advanced technologies without the burden of maintaining in-house capabilities. In 2025, the market for outsourced testing services is projected to grow by approximately 7%, reflecting the ongoing trend of cost optimization. By outsourcing, manufacturers can allocate resources more effectively, streamline their operations, and ultimately enhance their competitive positioning in the market.

Rising Demand for Quality Assurance

The Medical Device Analytical Testing Outsourcing Market is experiencing a notable increase in demand for quality assurance services. As medical devices become more complex, manufacturers are compelled to ensure that their products meet stringent quality standards. This trend is driven by heightened consumer awareness and regulatory scrutiny. In 2025, the market for analytical testing services is projected to reach approximately USD 5 billion, reflecting a compound annual growth rate of around 8%. This growth underscores the necessity for outsourcing testing services to specialized firms that can provide the required expertise and resources. Consequently, manufacturers are increasingly turning to outsourcing as a strategic approach to enhance product quality while maintaining compliance with regulatory requirements.

Expansion of Biologics and Combination Products

The Medical Device Analytical Testing Outsourcing Market is witnessing a significant expansion in the development of biologics and combination products. These products often require specialized analytical testing to ensure their safety and efficacy. As the market for biologics is expected to grow at a rate of 10% annually, the demand for analytical testing services tailored to these products is likely to increase correspondingly. Outsourcing testing services allows manufacturers to leverage the expertise of specialized laboratories that possess advanced technologies and methodologies. This trend not only accelerates the development process but also ensures compliance with regulatory standards, thereby enhancing the overall market landscape.