North America : Market Leader in Innovation

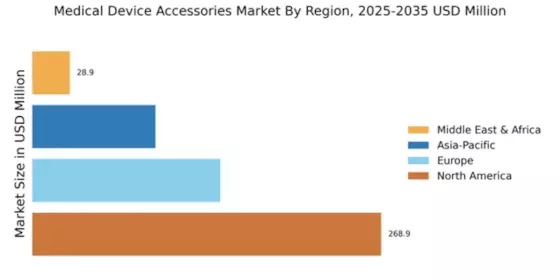

North America continues to lead the Medical Device Accessories Market, holding a significant market share of $268.95M in 2024. The region's growth is driven by advanced healthcare infrastructure, increasing prevalence of chronic diseases, and a strong focus on innovation. Regulatory support from agencies like the FDA further catalyzes market expansion, ensuring that new products meet stringent safety and efficacy standards.

The competitive landscape is robust, with key players such as Medtronic, Boston Scientific, and Abbott Laboratories dominating the market. The U.S. remains the largest contributor, benefiting from high healthcare spending and a strong emphasis on research and development. This environment fosters innovation, allowing companies to introduce cutting-edge accessories that enhance patient care and outcomes.

Europe : Emerging Market with Growth Potential

Europe's Medical Device Accessories Market is valued at $145.0M, showcasing a growing demand driven by an aging population and increasing healthcare expenditure. The region benefits from strong regulatory frameworks, such as the EU Medical Device Regulation, which ensures high safety standards and encourages innovation. This regulatory environment is pivotal in fostering trust among consumers and healthcare providers, thereby boosting market growth.

Leading countries like Germany, France, and the UK are at the forefront of this market, with a competitive landscape featuring major players like B. Braun Melsungen AG and Smith & Nephew. The presence of these companies, coupled with ongoing investments in R&D, positions Europe as a key player in the global market, driving advancements in medical technology and accessories.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific region is witnessing a surge in the Medical Device Accessories Market, valued at $95.0M. This growth is fueled by rising healthcare awareness, increasing disposable incomes, and a growing elderly population. Countries like China and India are experiencing rapid urbanization, leading to enhanced healthcare facilities and increased demand for medical accessories. Government initiatives aimed at improving healthcare infrastructure further support this growth trajectory.

The competitive landscape is evolving, with both local and international players vying for market share. Companies like Terumo Corporation and ConvaTec Group are expanding their presence in the region, capitalizing on the growing demand. The focus on affordable healthcare solutions and innovative products is driving competition, making Asia-Pacific a dynamic market for medical device accessories.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa (MEA) region, with a market size of $28.94M, is gradually emerging in the Medical Device Accessories Market. Growth is driven by increasing healthcare investments and a rising prevalence of chronic diseases. However, the market faces challenges such as regulatory hurdles and varying healthcare standards across countries. Despite these challenges, the region shows potential for growth as governments prioritize healthcare improvements.

Countries like South Africa and the UAE are leading the way, with a growing number of healthcare facilities and investments in medical technology. Key players are beginning to establish a foothold in the region, focusing on tailored solutions that meet local needs. The competitive landscape is evolving, with opportunities for growth as the market matures.