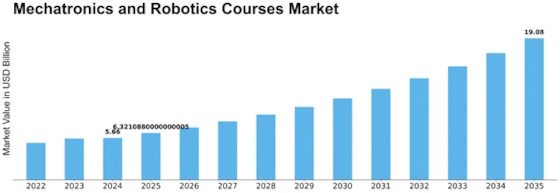

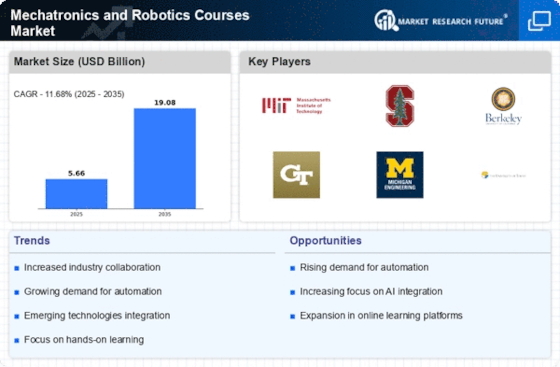

Mechatronics Robotics Courses Size

Mechatronics Robotics Courses Market Growth Projections and Opportunities

Numerous variables affect the market for robotics and mechatronics courses, which in turn shapes the industry's dynamics and growth trajectory. First and foremost, there is a critical need for qualified experts in the robotics and mechatronics fields around the world. The need for people knowledgeable in mechatronics and robotics is growing as more companies use automation and smart technology. Industries where automation boosts productivity and efficiency include manufacturing, healthcare, and logistics, which are the main drivers of this need. thereby, educational establishments providing courses on mechatronics and robotics are able to address the growing need for skilled laborers, thereby impacting the market.

Additionally, the market determinants for robotics and mechatronics courses are heavily influenced by technological breakthroughs. In order to stay up to speed with the most recent advancements, course content must be updated often due to the rapid evolution of mechatronics and robotics. Universities that include cutting-edge technology in their curricula—like machine learning, artificial intelligence, and the Internet of Things—are likely to draw in more students. The market for these courses is supported by the emphasis on keeping up with technological advances, which benefits students and guarantees that graduates are equipped to handle problems in their particular fields. It is impossible to ignore how government efforts and legislation have shaped the demand for robotics and mechatronics courses.

All throughout the world, governments understand how critical it is to promote competition and innovation in cutting-edge industries. As a result, several countries enact laws to promote the development of robotics and mechatronics. This assistance might take the form of capital for centers of excellence, financial support for research and development, or grants for educational establishments. These kinds of programs foster an atmosphere that is conducive to the growth of robotics and mechatronics education, which benefits the industry. Furthermore, the development of robotics and mechatronics education is greatly influenced by industrial partnerships and collaborations. Collaboration between academic institutions and business stakeholders guarantees that curricula meet the real-world demands of the labor market.

Leave a Comment