Expansion of Foodservice Sector

The expansion of the foodservice sector significantly influences the Meat Flavor Market, as restaurants and food chains increasingly incorporate diverse meat flavors into their menus. This trend is driven by consumer demand for unique and gourmet dining experiences, prompting foodservice operators to experiment with various meat flavor profiles. Market analysis indicates that the foodservice industry is expected to grow at a rate of 5% annually, creating opportunities for meat flavor manufacturers to collaborate with chefs and culinary experts. Such partnerships can lead to the development of innovative meat flavor solutions that enhance menu offerings, thereby driving sales and growth within the Meat Flavor Market.

Rising Demand for Processed Meat Products

The Meat Flavor Market experiences a notable increase in demand for processed meat products, driven by changing consumer lifestyles and preferences. As more individuals seek convenient meal options, the consumption of ready-to-eat and pre-packaged meat products rises. According to recent data, the processed meat segment is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This trend indicates a shift in consumer behavior, where the need for quick and easy meal solutions influences purchasing decisions. Consequently, manufacturers in the Meat Flavor Market are compelled to innovate and enhance flavor profiles to meet the evolving tastes of consumers, thereby driving growth in this sector.

Emerging Markets and Changing Demographics

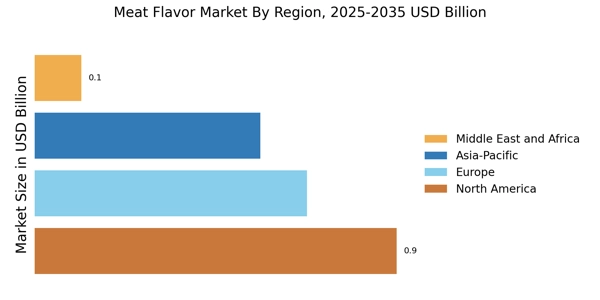

Emerging markets and changing demographics present new opportunities for the Meat Flavor Market. As urbanization continues to rise, there is an increasing demand for meat products in developing regions, where traditional diets are evolving. Younger consumers, particularly millennials and Generation Z, are more adventurous in their food choices, seeking bold and diverse flavors. This demographic shift indicates a potential for growth in the meat flavor segment, as manufacturers adapt their products to cater to these evolving tastes. Market data suggests that regions such as Asia-Pacific are experiencing rapid growth in meat consumption, which could lead to increased demand for innovative meat flavor solutions. Consequently, the Meat Flavor Market must remain agile to capitalize on these emerging trends.

Health Consciousness and Clean Label Trends

In recent years, there has been a marked increase in health consciousness among consumers, which significantly impacts the Meat Flavor Market. As individuals become more aware of the nutritional content of their food, there is a growing preference for clean label products that contain natural and recognizable ingredients. This trend is reflected in the rising sales of meat products that are free from artificial additives and preservatives. Market data suggests that products labeled as 'natural' or 'organic' are witnessing a surge in demand, with consumers willing to pay a premium for perceived health benefits. This shift compels manufacturers to reformulate their offerings, ensuring that flavor enhancements align with health trends, thus shaping the future of the Meat Flavor Market.

Technological Advancements in Flavor Development

Technological advancements play a crucial role in shaping the Meat Flavor Market, particularly in flavor development and enhancement. Innovations in flavor extraction and encapsulation techniques allow manufacturers to create more intense and diverse flavor profiles that cater to consumer preferences. The integration of artificial intelligence and machine learning in flavor formulation processes is also gaining traction, enabling companies to predict flavor trends and consumer preferences more accurately. As a result, the Meat Flavor Market is likely to witness a surge in product offerings that are not only flavorful but also tailored to specific dietary needs. This technological evolution may lead to increased competition among manufacturers, driving further innovation and growth in the sector.