Expansion of Tourism in MEA

The MEA Luxury Shuttle Bus Market is poised for growth due to the expansion of the tourism sector in the region. Countries like the United Arab Emirates and Saudi Arabia are investing heavily in tourism infrastructure, aiming to attract high-end travelers. The MEA region is expected to see a 10 percent increase in international tourist arrivals by 2027, which could significantly boost the demand for luxury shuttle services. Tourists often seek convenient and luxurious transportation options to explore attractions, leading to a higher utilization of shuttle services. This trend suggests that operators in the MEA Luxury Shuttle Bus Market may need to adapt their services to cater to the preferences of international visitors, offering tailored experiences that enhance their travel enjoyment.

Growing Urbanization in MEA

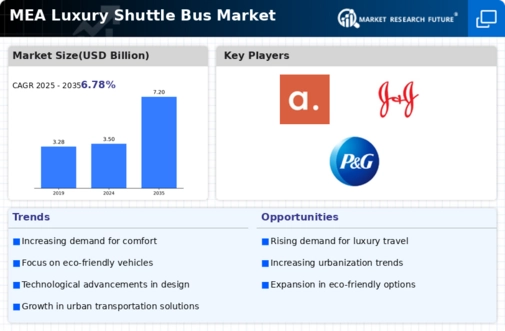

The MEA Luxury Shuttle Bus Market is experiencing a notable surge due to the rapid urbanization across the region. As cities expand and populations increase, the demand for efficient and luxurious transportation options rises. Urban centers such as Dubai and Riyadh are witnessing significant growth in their infrastructure, leading to a higher need for shuttle services that cater to affluent clients. According to recent data, urbanization in the MEA region is projected to reach 70 percent by 2030, which could further drive the luxury shuttle bus market. This trend indicates that more individuals are seeking comfortable and stylish travel options, thereby enhancing the appeal of luxury shuttle services. Consequently, operators in the MEA Luxury Shuttle Bus Market are likely to invest in modern fleets to meet the expectations of urban dwellers.

Increased Focus on Corporate Travel

The MEA Luxury Shuttle Bus Market is significantly influenced by the rising emphasis on corporate travel. As businesses expand their operations in the region, there is a growing need for premium transportation solutions for executives and clients. Companies are increasingly opting for luxury shuttle services to ensure comfort and efficiency during business trips. Data suggests that corporate travel spending in the MEA region is expected to grow at a compound annual growth rate of 5.5 percent over the next five years. This trend indicates a robust market for luxury shuttle services tailored to corporate clients, who prioritize high-quality travel experiences. As a result, operators in the MEA Luxury Shuttle Bus Market are likely to enhance their offerings, providing amenities such as Wi-Fi, refreshments, and comfortable seating to attract this lucrative segment.

Government Initiatives Supporting Luxury Transport

The MEA Luxury Shuttle Bus Market benefits from various government initiatives aimed at enhancing transportation services. Governments in the region are increasingly recognizing the importance of luxury transport solutions in promoting tourism and business travel. For instance, initiatives to improve road infrastructure and public transport systems are being implemented, which could facilitate the growth of luxury shuttle services. Additionally, policies encouraging private investments in the transportation sector may lead to an influx of new operators in the luxury shuttle market. This supportive regulatory environment indicates a favorable outlook for the MEA Luxury Shuttle Bus Market, as it may attract more players and enhance service quality, ultimately benefiting consumers.

Technological Integration in Luxury Shuttle Services

The MEA Luxury Shuttle Bus Market is witnessing a transformation driven by technological integration. Advancements in fleet management systems, GPS tracking, and mobile applications are enhancing the efficiency and appeal of luxury shuttle services. Operators are increasingly adopting these technologies to provide real-time updates, streamline operations, and improve customer experiences. Data indicates that the adoption of technology in the transportation sector is expected to grow by 15 percent annually in the MEA region. This trend suggests that luxury shuttle service providers may leverage technology to offer personalized services, such as tailored routes and on-demand bookings, thereby attracting a broader clientele. Consequently, the integration of technology appears to be a key driver for the MEA Luxury Shuttle Bus Market, potentially reshaping the competitive landscape.