Growing Air Traffic in MEA Region

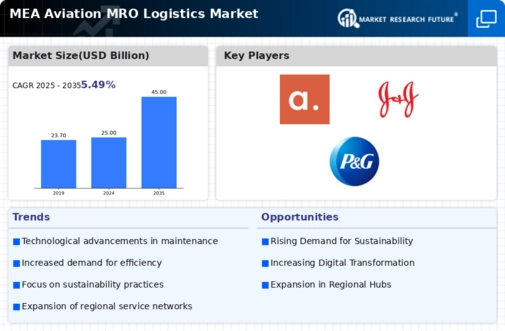

The MEA Aviation Mro Logistics Market is experiencing a notable surge in air traffic, driven by increasing passenger demand and the expansion of low-cost carriers. According to recent data, the region's air traffic is projected to grow at a compound annual growth rate of approximately 5.5% over the next decade. This growth necessitates enhanced maintenance, repair, and overhaul (MRO) services to ensure aircraft safety and reliability. As airlines expand their fleets to accommodate rising passenger numbers, the demand for efficient logistics solutions in the MRO sector becomes paramount. Consequently, stakeholders in the MEA Aviation Mro Logistics Market are likely to invest in advanced logistics technologies and infrastructure to support this burgeoning air traffic, thereby fostering a more robust MRO ecosystem.

Rising Demand for Sustainable Practices

The MEA Aviation Mro Logistics Market is increasingly influenced by the rising demand for sustainable practices within the aviation sector. Stakeholders are becoming more aware of the environmental impact of aviation operations, prompting a shift towards greener MRO solutions. Airlines are seeking logistics providers that prioritize sustainability, such as those utilizing eco-friendly materials and energy-efficient processes. This trend is evident in initiatives aimed at reducing carbon emissions and waste in MRO operations. As sustainability becomes a key focus, MRO providers in the MEA region are likely to adapt their logistics strategies to align with these environmental goals, potentially leading to a more sustainable aviation ecosystem.

Government Regulations and Safety Standards

The MEA Aviation Mro Logistics Market is significantly influenced by stringent government regulations and safety standards. Regulatory bodies across the region are implementing comprehensive frameworks to ensure the safety and security of air travel. For instance, the General Civil Aviation Authority in the UAE has established rigorous guidelines for MRO operations, which compel service providers to adhere to high safety standards. This regulatory environment not only enhances operational safety but also drives demand for specialized logistics services that comply with these regulations. As a result, MRO providers in the MEA region are increasingly focusing on quality assurance and compliance, which may lead to higher operational costs but ultimately contributes to a safer aviation environment.

Technological Advancements in MRO Logistics

The MEA Aviation Mro Logistics Market is witnessing a transformative phase due to rapid technological advancements. Innovations such as predictive maintenance, artificial intelligence, and blockchain technology are reshaping the logistics landscape within the MRO sector. For example, predictive maintenance tools enable airlines to anticipate maintenance needs, thereby optimizing logistics operations and reducing downtime. Furthermore, the integration of blockchain technology enhances transparency and traceability in the supply chain, which is crucial for MRO logistics. As these technologies become more prevalent, MRO providers in the MEA region are likely to adopt them to improve efficiency and reduce costs, ultimately leading to a more competitive market.

Increased Investment in Aviation Infrastructure

The MEA Aviation Mro Logistics Market is benefiting from substantial investments in aviation infrastructure across the region. Governments and private entities are channeling resources into expanding airports and MRO facilities to accommodate the growing air traffic. For instance, the expansion of Dubai International Airport and the development of new MRO facilities in Saudi Arabia are indicative of this trend. Such investments not only enhance the capacity of the aviation sector but also create opportunities for logistics providers to offer specialized MRO services. As infrastructure improves, the efficiency of logistics operations is likely to increase, thereby supporting the overall growth of the MEA Aviation Mro Logistics Market.