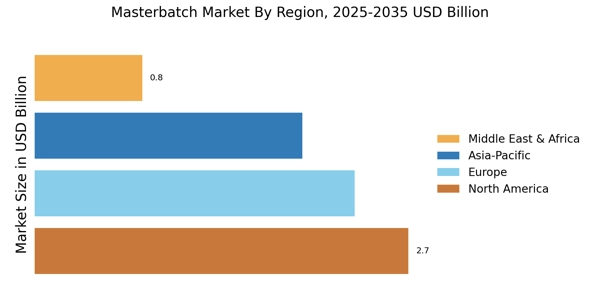

North America : Innovation and Demand Surge

North America is witnessing robust growth in the Masterbatch Market, driven by increasing demand from the packaging, automotive, and consumer goods sectors. The region holds approximately 35% of the global market share, making it the largest market. Regulatory support for sustainable materials and innovations in production processes are further propelling this growth. The shift towards eco-friendly solutions is a significant catalyst for market expansion. The United States leads the North American market, with key players like Clariant, BASF, and DOW establishing a strong presence. The competitive landscape is characterized by continuous innovation and strategic partnerships among major companies. Canada also contributes to the market, focusing on sustainable practices and advanced manufacturing technologies. The presence of these key players ensures a dynamic and competitive environment in the region.

Europe : Sustainability and Innovation Focus

Europe is emerging as a significant player in the Masterbatch Market, driven by stringent regulations on plastic usage and a strong emphasis on sustainability. The region accounts for approximately 30% of the global market share, making it the second-largest market. Regulatory frameworks, such as the EU Plastics Strategy, are catalyzing the shift towards biodegradable and recyclable materials, enhancing market growth. The demand for high-quality masterbatches in various applications is also on the rise. Germany, France, and the UK are leading countries in this market, with companies like BASF and Evonik at the forefront. The competitive landscape is marked by innovation in product offerings and a focus on sustainable solutions. The presence of numerous small and medium enterprises alongside major players fosters a dynamic market environment. This competitive edge is crucial for meeting the evolving demands of consumers and regulatory bodies alike.

Asia-Pacific : Emerging Markets and Growth Potential

The Asia-Pacific region is experiencing rapid growth in the Masterbatch Market, fueled by increasing industrialization and urbanization. This region holds approximately 25% of the global market share, driven by countries like China and India, which are witnessing a surge in demand for packaging and automotive applications. Government initiatives promoting manufacturing and infrastructure development are significant growth drivers, alongside rising consumer awareness regarding product quality and sustainability. China is the largest market in the region, with a strong presence of key players such as SABIC and A. Schulman. India is also emerging as a vital market, with increasing investments in manufacturing capabilities. The competitive landscape is characterized by a mix of local and international players, fostering innovation and competitive pricing strategies. This dynamic environment is essential for meeting the diverse needs of various industries in the region.

Middle East and Africa : Resource-Rich and Growing Demand

The Middle East and Africa region is witnessing a gradual increase in the Masterbatch Market, driven by growing industrial activities and a rising demand for plastic products. This region currently holds about 10% of the global market share. The growth is supported by government initiatives aimed at diversifying economies and enhancing manufacturing capabilities. Additionally, the increasing focus on sustainable practices is shaping market dynamics, with a shift towards eco-friendly masterbatches. Countries like South Africa and the UAE are leading the market, with investments in infrastructure and manufacturing facilities. The competitive landscape is evolving, with both local and international players vying for market share. Key companies such as Kraton and Ampacet are establishing a foothold in the region, contributing to the overall growth and innovation in the masterbatch market. This competitive environment is crucial for addressing the unique demands of the region's diverse industries.

South America: Rapidly Develop Masterbatch

The South America, the packaging sector continues to be the primary user of masterbatches, mostly for use in household, personal care, and food and beverage products. Due to financial constraints, there is a noticeable shift toward value-added functionalities like UV protection, anti-fog, and antimicrobial additives, but the demand is still primarily for standard color masterbatches (such as white, black, and primary colors). There is pressure to meet global packaging standards for food contact safety, recyclability, and even traceability because many regional converters serve multinational FMCG companies. Because of this, masterbatch suppliers are now trying to create formulations that comply with FDA and EU standards, even in cases where local laws do not yet require them. Adoption of sustainability is still in its early stages, but it is gaining traction. Some nations are advancing extended producer responsibility (EPR) legislation, plastic bag bans, and packaging targets for recycled content, especially Chile and Colombia.