Regulatory Compliance and Safety Standards

The Maritime Safety System Market is significantly influenced by stringent regulatory compliance and safety standards imposed by various maritime authorities. These regulations are designed to ensure the safety of vessels, crew, and cargo, thereby fostering a culture of safety within the industry. Compliance with international standards such as the International Maritime Organization's (IMO) regulations is essential for maritime operators. As of 2025, it is estimated that compliance-related expenditures will account for nearly 15% of total operational costs for maritime companies. This emphasis on regulatory adherence drives investment in advanced safety systems, as companies seek to avoid penalties and enhance their reputational standing in the market.

Emerging Markets and Investment Opportunities

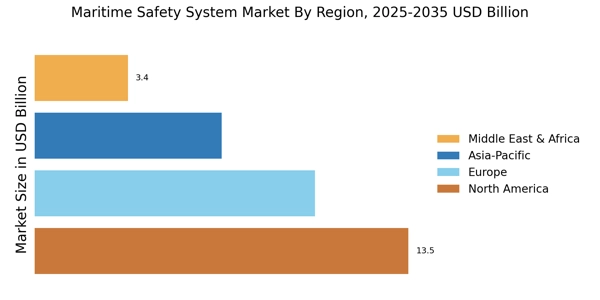

The Maritime Safety System Market is witnessing a shift towards emerging markets, which presents new investment opportunities. Countries with expanding maritime sectors are increasingly investing in safety systems to enhance their operational capabilities and meet international safety standards. For instance, regions in Asia and Africa are experiencing rapid growth in their shipping industries, leading to a demand for advanced maritime safety technologies. It is projected that investments in these emerging markets will contribute to a significant portion of the overall market growth, potentially reaching a valuation of several billion dollars by 2030. This trend indicates a promising future for stakeholders in the maritime safety sector.

Increased Focus on Human Factors in Maritime Safety

The Maritime Safety System Market is increasingly recognizing the importance of human factors in enhancing safety outcomes. Human error remains a leading cause of maritime accidents, prompting a shift towards systems that prioritize crew training, situational awareness, and decision-making processes. As a result, there is a growing demand for safety systems that incorporate human factors engineering principles. This trend is reflected in the development of simulation-based training programs and user-friendly interfaces that facilitate better interaction between crew members and safety systems. By addressing human factors, the industry aims to reduce incidents and improve overall safety performance.

Rising Maritime Trade and Transportation Activities

The Maritime Safety System Market is poised for growth due to the rising maritime trade and transportation activities. As global trade continues to expand, the volume of cargo transported by sea is increasing, necessitating enhanced safety measures to protect vessels and their crews. Recent statistics indicate that maritime trade is expected to grow by approximately 4% annually, leading to a heightened focus on safety systems that can accommodate larger and more complex shipping operations. This trend underscores the need for robust maritime safety systems that can effectively manage the risks associated with increased shipping traffic and ensure compliance with safety regulations.

Technological Advancements in Maritime Safety Systems

The Maritime Safety System Market is experiencing a surge in technological advancements that enhance safety protocols and operational efficiency. Innovations such as automated navigation systems, real-time monitoring, and advanced communication technologies are becoming increasingly prevalent. For instance, the integration of artificial intelligence and machine learning into maritime safety systems allows for predictive analytics, which can foresee potential hazards and mitigate risks. According to recent data, the market for maritime safety technologies is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. This growth is indicative of the industry's commitment to adopting cutting-edge solutions that not only comply with safety regulations but also improve overall maritime operations.