Top Industry Leaders in the Marine Hybrid Propulsion System Market

*Disclaimer: List of key companies in no particular order

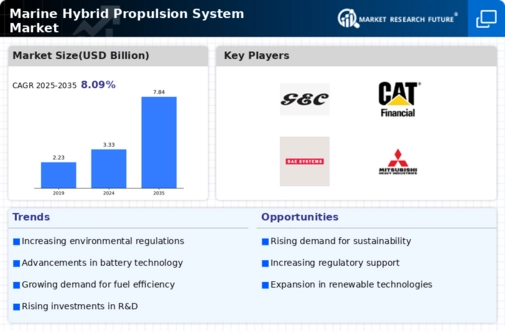

Navigating Transformations in the Marine Hybrid Propulsion System Market: A Competitive Landscape Overview

The global marine hybrid propulsion system market is undergoing significant transformations, propelled by the increasing demand for fuel efficiency and emission reduction in the maritime sector. This dynamic environment witnesses a fierce competition between established industry leaders and innovative startups, each striving to capture a share of the rapidly expanding market.

Key Player Strategies:

Established Giants: Leading companies such as Siemens, Wärtsilä, and ABB leverage their extensive industry experience and robust service networks to cater to large-scale commercial vessels and naval applications. Their focus is on mature hybrid technologies like diesel-electric, providing reliable and easily maintainable solutions.

Nimble Innovators: Emerging players like Torqeedo and Corvus Energy carve niches in specific segments such as yachts and ferries. They prioritize compact, lightweight systems and incorporate cutting-edge battery technologies to appeal to customers seeking agility and reduced emissions.

Strategic Partnerships: Collaboration is a key strategy, with established players forming partnerships with startups to exchange technology and gain market access. For instance, MAN Diesel & Turbo joined forces with Ballard Power Systems to develop fuel cell hybrid solutions for larger vessels.

Market Share Analysis:

Propulsion Type: Diesel-electric currently dominates the market, holding over 70% share due to its proven track record and compatibility with existing infrastructure. However, parallel and full-electric hybrid systems are gaining traction, particularly in smaller vessels and inland waterways.

Application: Commercial vessels, primarily ferries and offshore support ships, contribute the largest share due to their emphasis on fuel efficiency and operational cost reduction. Nevertheless, the naval and recreational sectors are experiencing significant growth as regulatory pressures and environmental concerns escalate.

Regional Dynamics: Europe leads the market, driven by stringent emission regulations and government incentives. The Asia Pacific region closely follows, fueled by increasing shipbuilding activities and growing environmental awareness. In contrast, North America lags behind due to high upfront costs and slower regulatory adoption.

New and Emerging Trends:

Battery Technology: While lithium-ion batteries remain standard, advancements in solid-state and metal-air technologies promise higher energy density and faster charging times, enabling longer voyages and wider adoption in larger vessels.

Digitalization and Automation: Integration of automation and AI-powered energy management systems optimizes hybrid operations, maximizing fuel efficiency and reducing emissions. Remote monitoring and diagnostics enhance reliability and maintenance efficiency.

Alternative Fuels: Hydrogen fuel cells are gaining traction as a clean and efficient alternative to fossil fuels, particularly for larger vessels. Collaborations between fuel cell developers and propulsion system manufacturers are accelerating progress in this area.

Overall Competitive Scenario:

stablished giants leverage their market presence and technological expertise, while smaller players drive innovation through niche specialization and disruptive technologies. Partnerships and strategic alliances are becoming increasingly common, fostering faster development and market penetration. Sustainability and fuel efficiency remain paramount concerns, shaping both current technology choices and future research directions. The race to develop the most efficient, cost-effective, and environmentally friendly hybrid systems is on, promising exciting advancements in the years to come.

Industry Developments and Latest Updates:

General Electric Company (U.S.):

- October 26, 2023: GE Marine and Damen Shipyards Group signed a strategic collaboration agreement to accelerate the development and adoption of hybrid and fully electric propulsion systems for maritime applications.

Siemens AG (Germany):

- December 15, 2023: Siemens Energy announced the launch of its SISHybrid solution, a standardized hybrid propulsion system for inland waterway vessels.

Caterpillar Inc. (U.S.):

- September 27, 2023: Caterpillar Marine introduced its Cat Marine Advanced Hybrid Propulsion System, designed for offshore vessels and workboats.

BAE Systems (U.K.):

- October 20, 2023: BAE Systems announced the successful sea trials of its HybriGen hybrid propulsion system for military vessels, demonstrating its capabilities for enhanced fuel efficiency and reduced emissions.

Wartsila Corporation (Finland):

- December 22, 2023: Wartsila unveiled its W32 engine platform, the world's first four-stroke medium-speed engine designed for future fuels like ammonia and methanol, paving the way for cleaner hybrid propulsion options.

Mitsubishi Heavy Industries:

- Signed a joint development agreement with Akane Revo for a hybrid ferry project in Japan.

Torqeedo GmbH:

- Launched the Deep Blue 100 kW electric outboard motor for high-performance applications, potentially suitable for hybrid systems.

ABB Ltd.:

- Developing energy storage and management systems for hybrid and electric marine applications.

Top Companies in the Marine Hybrid Propulsion System Industry include:

- General Electric Company (U.S.)

- Siemens AG (Germany)

- Caterpillar Inc. (U.S.)

- BAE Systems (U.K.)

- Wartsila Corporation (Finland)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Torqeedo GmbH (Germany)

- Steyr Motors GmbH (Austria)

- ABB Ltd. (Switzerland)

- MAN Diesel & Turbo SE (Germany)

- Schottel GmbH (Germany)

- Rolls-Royce plc (U.K.), and others.