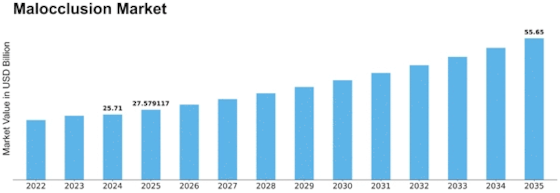

Malocclusion Size

Malocclusion Market Growth Projections and Opportunities

The superiority of malocclusion conditions and demographic factors strongly influences the market dynamics of the Malocclusion Market. As the occurrence of malocclusion rises, especially among youngsters and teens, the demand for orthodontic remedies and corrective measures will increase, shaping market growth. Evolving trends in orthodontic treatments, which include the popularity of clean aligners, braces, and different corrective devices, substantially impact the market. Patient options and the reputation of more recent, extra aesthetically attractive alternatives contribute to the dynamic nature of the malocclusion market. Growing aesthetic worries and the influence of social factors contribute to the demand for orthodontic treatments. The preference for a visually attractive smile and the effect of societal perceptions power people to seek orthodontic answers, stimulating market increase. The volume of coverage coverage for orthodontic approaches influences the market dynamics. Comprehensive coverage plans that cover orthodontic treatments can increase accessibility for patients, riding demand for corrective measures to address malocclusion. Economic situations, which include disposable income degrees, impact the affordability of orthodontic remedies. Economic stability can cause accelerated spending on non-obligatory healthcare techniques, definitely influencing the malocclusion market. The quantity and practices of dentists and orthodontists in a given region contribute to market dynamics. Areas that receive better attention from dental experts may additionally experience extended competition and innovation in malocclusion remedies. Cultural attitudes toward oral health and beauty requirements range globally, influencing the prevalence of malocclusion and the demand for corrective measures. Cultural perceptions of aesthetics and the importance of dental health affect the local market panorama. Regulatory frameworks for orthodontic gadgets and remedies influence market access and product adoption. Stringent approval strategies ensure the safety and efficacy of orthodontic solutions, constructing consideration among patients and practitioners. The willingness of orthodontic practices to undertake and integrate new technologies into their treatment offerings influences the market. Practices that include technological improvements may also entice a bigger affected person base seeking current and efficient malocclusion solutions. Ongoing studies and development activities inside the discipline of orthodontics contribute to market increase.

Leave a Comment