Rising Fuel Prices

The fluctuation of fuel prices in Malaysia has a direct impact on consumer behavior, leading to increased interest in electric motorcycles. As fuel costs rise, consumers are seeking more economical transportation options, which enhances the attractiveness of electric motorcycles. The Malaysia Electric Motorcycles Market is likely to benefit from this trend, as electric motorcycles typically offer lower operating costs compared to their gasoline counterparts. As of January 2026, the economic advantages of electric motorcycles are becoming more pronounced, prompting consumers to consider them as a long-term investment. This shift in consumer sentiment could significantly boost market demand.

Growing Environmental Awareness

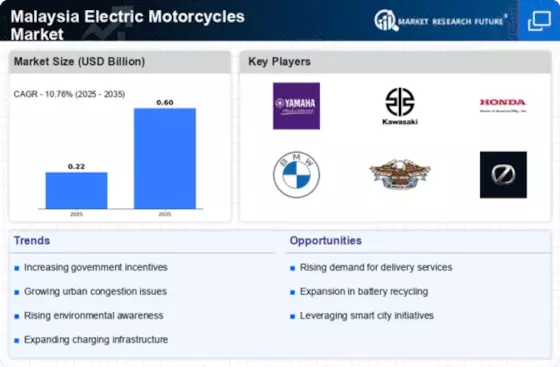

There is a notable increase in environmental consciousness among Malaysian consumers, which is driving the demand for electric motorcycles. As urban areas face pollution challenges, the Malaysia Electric Motorcycles Market benefits from a shift towards cleaner transportation options. Surveys indicate that a significant portion of the population is willing to consider electric motorcycles as a viable alternative to conventional vehicles. This growing awareness is further supported by educational campaigns and community initiatives aimed at promoting sustainable practices. Consequently, the market is likely to expand as more individuals recognize the environmental benefits of electric motorcycles.

Government Incentives and Policies

The Malaysian government actively promotes the adoption of electric motorcycles through various incentives and policies. The National Electric Mobility Blueprint aims to increase the number of electric vehicles, including motorcycles, on the roads. This initiative includes tax exemptions and subsidies for electric motorcycle manufacturers and consumers. As of January 2026, the government has allocated significant funding to support the development of charging infrastructure, which is crucial for the growth of the Malaysia Electric Motorcycles Market. These policies not only encourage local production but also attract foreign investments, thereby enhancing the overall market landscape.

Urbanization and Traffic Congestion

Rapid urbanization in Malaysia has led to increased traffic congestion, particularly in major cities like Kuala Lumpur. This situation creates a pressing need for efficient and compact transportation solutions, positioning electric motorcycles as an attractive option. The Malaysia Electric Motorcycles Market is poised to capitalize on this trend, as electric motorcycles offer maneuverability and ease of parking in crowded urban environments. As of January 2026, local authorities are exploring policies to encourage the use of electric motorcycles to alleviate traffic woes, which could further stimulate market growth. The convenience and efficiency of electric motorcycles may appeal to urban commuters seeking alternatives to traditional vehicles.

Technological Advancements in Battery Systems

Innovations in battery technology are pivotal for the Malaysia Electric Motorcycles Market. The development of lithium-ion batteries with higher energy densities and faster charging capabilities has made electric motorcycles more appealing to consumers. As of January 2026, several Malaysian manufacturers are collaborating with technology firms to enhance battery performance and reduce costs. This trend is likely to lead to a broader acceptance of electric motorcycles, as consumers seek reliable and efficient alternatives to traditional gasoline-powered bikes. The ongoing research and development in battery technology could potentially revolutionize the market, making electric motorcycles a mainstream choice.