Low Voltage Cables & Accessories Market Summary

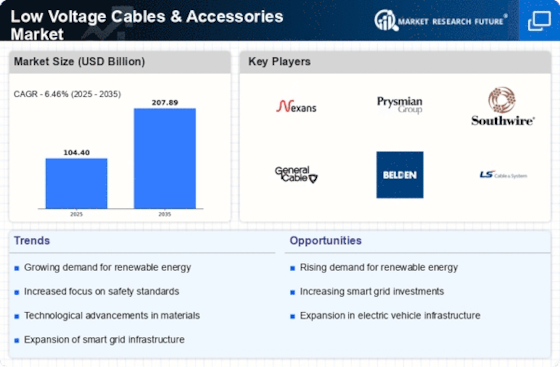

As per Market Research Future analysis, the Low Voltage Cables & Accessories Market was estimated at 104.4 USD Billion in 2024. The Low Voltage Cables & Accessories industry is projected to grow from 111.15 USD Billion in 2025 to 207.89 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.46% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Low Voltage Cables and Accessories Market is poised for substantial growth driven by sustainability and technological advancements.

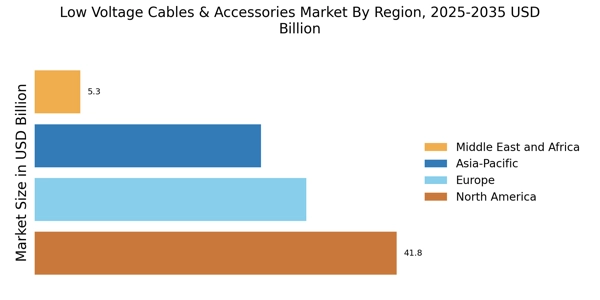

- The North American market remains the largest, reflecting a robust demand for low voltage cables and accessories.

- Asia-Pacific is emerging as the fastest-growing region, propelled by rapid urbanization and infrastructure development.

- The underground segment continues to dominate the market, while the overground segment is witnessing the fastest growth due to increasing energy needs.

- Key market drivers include the rising demand for renewable energy and the expansion of electric vehicle infrastructure, which are shaping industry dynamics.

Market Size & Forecast

| 2024 Market Size | 104.4 (USD Billion) |

| 2035 Market Size | 207.89 (USD Billion) |

| CAGR (2025 - 2035) | 6.46% |

Major Players

Nexans (FR), Prysmian Group (IT), Southwire Company (US), General Cable (US), Belden Inc. (US), LS Cable & System (KR), AFL (US), Sumitomo Electric Industries (JP), TE Connectivity (CH)