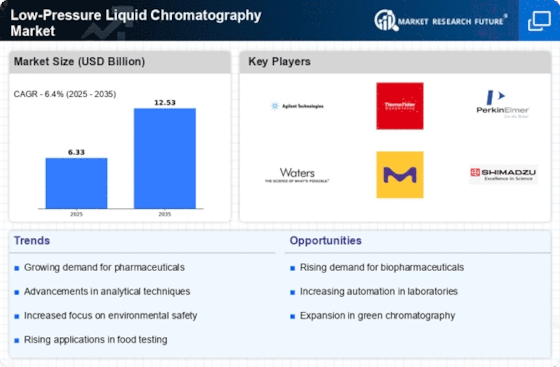

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Low-Pressure Liquid Chromatography market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Low-Pressure Liquid Chromatography industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Low-Pressure Liquid Chromatography industry to benefit clients and increase the market sector. In recent years, the Low-Pressure Liquid Chromatography industry has offered some of the most significant advantages to medicine. Major players in the Low-Pressure Liquid Chromatography market, including Novasep, LEWA GmbH, Biolinx Labsystems, Bio-Rad Laboratories Inc., Danaher Corporation, and Nilsan Nishotech Systems Pvt. Ltd., are attempting to increase market demand by investing in research and development operations.

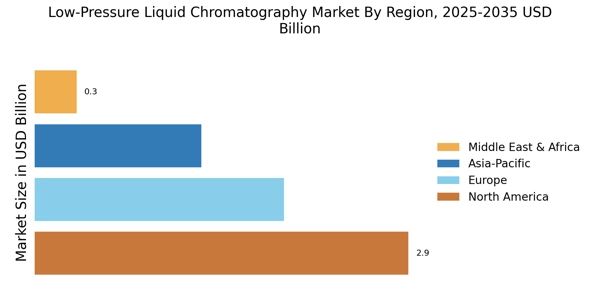

Danaher Corp. (Danaher) develops, produces, and sells industrial, commercial, professional, and medical goods and services. A wide range of testing equipment, communications solutions, water quality systems, medical diagnostic solutions, life science research tools, professional microscopes, product identification solutions, sustainable packaging design solutions, automation solutions, and sensors and controls solutions are all available. In Europe, Australia, Asia, and the Americas, the corporation has facilities for manufacturing, sales, distribution, service, and administration. Through direct sales representatives and independent distributors, the company reaches customers throughout the Americas, Europe, the Middle East, Africa, and Asia-Pacific with its products.

Washington, DC, in the US, serves as the company's headquarters. In order to increase its knowledge of low-pressure liquid chromatography technology, Danaher Corporation (US) purchased General Electric's Healthcare Life Sciences Biopharma Business in December 2019. Purification is a feature of GE's KTAprocess, a low-pressure liquid chromatography system. The purchase broadened the business's offering in the low-pressure liquid chromatography sector.

One of the top producers and providers of low-pressure liquid chromatography equipment and supplies is Bio-Rad Laboratories, Inc. (US). The BioLogic LP low-pressure chromatography system from Bio-Rad Laboratories, Inc. (US) is used in particular for the purification of biomolecules. Because of its small size, the device requires less installation area. For the purpose of detecting proteins and nucleic acids, the device has 254 and 280 nm filters built in. A conductivity cell is also included in the system to track gradient development.

The dual-channel peristaltic pump, which is integrated with the low-pressure liquid chromatography system, generates a back pressure of 30 psi. The company sells a variety of accessories, such as the BioFrac Fraction Collector, Model 2110 Fraction Collector, Econo Gradient Pump, Biologic LP Valves, and Biologic LP Data View Software.