Growing Volume of Data

The exponential growth of data generated by organizations is a significant factor influencing the Log Management Software Market. As businesses increasingly rely on digital platforms, the volume of logs produced has surged, necessitating advanced log management solutions to handle this influx. Reports indicate that the total data created worldwide is expected to reach 175 zettabytes by 2025. This surge in data volume presents challenges in storage, analysis, and retrieval, thereby driving the demand for sophisticated log management tools that can efficiently process and analyze large datasets.

Increasing Cybersecurity Threats

The Log Management Software Market is experiencing heightened demand due to the increasing frequency and sophistication of cybersecurity threats. Organizations are compelled to adopt robust log management solutions to monitor, analyze, and respond to potential security incidents. According to recent data, The Log Management Software Market is projected to reach USD 345.4 billion by 2026, indicating a strong correlation between cybersecurity investments and the need for effective log management. As cyber threats evolve, the ability to maintain comprehensive logs becomes essential for incident response and forensic analysis, thereby driving growth in the log management software sector.

Regulatory Compliance Requirements

Regulatory compliance is a critical driver for the Log Management Software Market, as organizations face stringent requirements from various regulatory bodies. Compliance mandates, such as GDPR, HIPAA, and PCI DSS, necessitate the collection and retention of logs for auditing and reporting purposes. The market for compliance-related software is expected to grow significantly, with estimates suggesting a compound annual growth rate of 12.5% through 2027. This trend underscores the importance of log management solutions in ensuring that organizations can meet compliance standards while minimizing the risk of penalties and reputational damage.

Shift Towards Cloud-Based Solutions

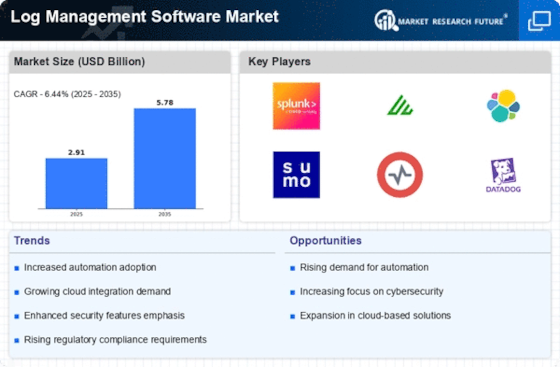

The transition to cloud-based infrastructures is reshaping the Log Management Software Market. Organizations are increasingly adopting cloud solutions for their flexibility, scalability, and cost-effectiveness. The cloud segment of the log management market is projected to grow at a CAGR of 15% over the next five years. This shift allows businesses to leverage advanced analytics and machine learning capabilities, enhancing their log management processes. As more organizations migrate to the cloud, the demand for cloud-native log management solutions is likely to increase, further propelling market growth.

Need for Enhanced Operational Efficiency

Operational efficiency remains a pivotal driver for the Log Management Software Market. Organizations are recognizing the value of log management in streamlining operations, improving system performance, and reducing downtime. By implementing effective log management solutions, businesses can gain insights into system behavior, identify bottlenecks, and optimize resource allocation. Studies suggest that organizations utilizing log management tools can reduce incident response times by up to 50%. This potential for enhanced efficiency is likely to encourage more companies to invest in log management software, thereby fostering market expansion.