Technological Innovations

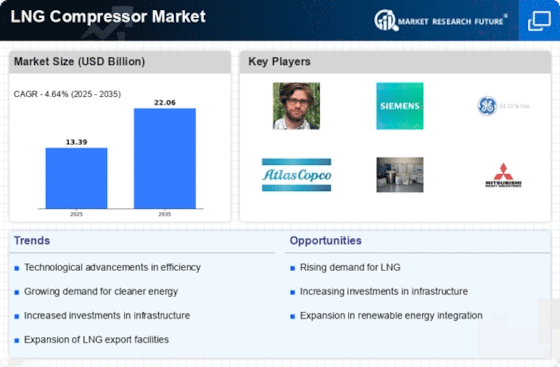

Technological advancements play a crucial role in shaping the LNG Compressor Market. Innovations in compressor design, efficiency, and automation are enhancing the performance and reliability of LNG compressors. For instance, the development of advanced materials and control systems is enabling compressors to operate at higher efficiencies and lower emissions. This trend is particularly relevant as industries seek to optimize their operations and reduce costs. Furthermore, the integration of digital technologies, such as IoT and AI, is likely to revolutionize the LNG Compressor Market by providing real-time monitoring and predictive maintenance capabilities, thereby improving operational efficiency.

Rising Demand for Clean Energy

The increasing The LNG Compressor Industry. As nations strive to reduce carbon emissions, liquefied natural gas (LNG) emerges as a cleaner alternative to traditional fossil fuels. This shift is evident in the growing investments in LNG infrastructure, with the International Energy Agency reporting a significant rise in LNG consumption. The demand for LNG compressors, which facilitate the transportation and storage of LNG, is likely to surge as industries and governments prioritize sustainable energy solutions. Furthermore, the LNG Compressor Market is expected to benefit from the transition towards cleaner energy, as LNG is perceived as a bridge fuel in the journey towards a low-carbon future.

Investment in LNG Infrastructure

The LNG Compressor Market is significantly influenced by the ongoing investments in LNG infrastructure. Governments and private entities are channeling funds into the development of LNG terminals, pipelines, and storage facilities to enhance the supply chain. Recent reports indicate that investments in LNG infrastructure are expected to exceed several billion dollars in the next few years. This influx of capital not only boosts the demand for LNG compressors but also fosters technological advancements within the industry. As infrastructure expands, the need for efficient and reliable LNG compressors becomes paramount, thereby driving the growth of the LNG Compressor Market.

Increasing Industrial Applications

The LNG Compressor Market experiences growth due to the expanding applications of LNG across various industrial sectors. Industries such as power generation, transportation, and manufacturing increasingly adopt LNG as a fuel source, driven by its cost-effectiveness and lower environmental impact. According to recent data, the industrial sector's demand for LNG is projected to grow at a compound annual growth rate of over 5% in the coming years. This trend indicates a robust market for LNG compressors, which are essential for the efficient handling and processing of LNG in these applications. As industries continue to seek reliable and efficient energy solutions, the LNG Compressor Market is poised for substantial growth.

Regulatory Frameworks and Policies

The LNG Compressor Market is also influenced by the evolving regulatory frameworks and policies aimed at promoting cleaner energy sources. Governments worldwide are implementing regulations that favor the use of LNG over more polluting fuels. These policies often include incentives for LNG infrastructure development and stricter emissions standards for traditional fuels. As a result, the LNG Compressor Market is likely to benefit from a favorable regulatory environment that encourages investment and innovation. The alignment of regulatory support with market demand for cleaner energy solutions suggests a promising outlook for the LNG Compressor Market in the coming years.