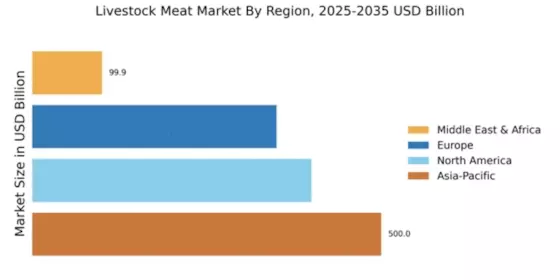

North America : Established Market Leaders

The North American livestock meat market, valued at $400.0 billion, is driven by strong consumer demand for high-quality meat products and a robust supply chain. Regulatory support, including food safety standards and trade agreements, further enhances market stability. The region's focus on sustainability and animal welfare is also shaping production practices, leading to increased consumer trust and market growth.

Leading players like Tyson Foods, Cargill, and Smithfield dominate the competitive landscape, leveraging advanced technologies and efficient distribution networks. The U.S. remains the largest market, with Canada and Mexico also contributing significantly. The presence of major companies ensures a diverse product range, catering to both domestic and international markets.

Europe : Diverse Consumer Preferences

Europe's livestock meat market, valued at $350.0 billion, is characterized by diverse consumer preferences and a strong emphasis on sustainability. Regulatory frameworks, such as the EU's Common Agricultural Policy, promote environmentally friendly practices and animal welfare, driving demand for organic and locally sourced meat products. The region's commitment to reducing carbon footprints is reshaping production methods and consumer choices.

Countries like Germany, France, and the UK lead the market, with significant contributions from Denmark and the Netherlands. Key players, including Danish Crown and BRF S.A., are adapting to changing consumer demands by innovating product offerings. The competitive landscape is marked by a mix of large corporations and smaller, niche producers, ensuring a wide variety of options for consumers.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific livestock meat market, the largest at $500.0 billion, is experiencing rapid growth driven by increasing urbanization, rising incomes, and changing dietary preferences. The region's demand for meat is expected to continue rising, supported by government initiatives to enhance food security and improve livestock production efficiency. Regulatory frameworks are evolving to address food safety and quality standards, further boosting consumer confidence.

China and India are the leading countries in this market, with significant contributions from Japan and Australia. Major players like NH Foods and JBS S.A. are expanding their operations to meet the growing demand. The competitive landscape is dynamic, with both local and international companies vying for market share, leading to innovation and improved product offerings.

Middle East and Africa : Growing Demand for Meat Products

The Middle East and Africa livestock meat market, valued at $99.92 billion, is witnessing growth driven by increasing population and urbanization. Rising disposable incomes are leading to higher meat consumption, while government initiatives aim to enhance local production capabilities. Regulatory frameworks are being developed to ensure food safety and quality, which are crucial for building consumer trust in the market.

Countries like South Africa, Nigeria, and Egypt are key players in this region, with local producers and international companies competing for market share. The presence of major players such as Marfrig Global Foods and Fletcher International Exports is enhancing the competitive landscape. As the market evolves, there is a growing focus on improving supply chains and meeting consumer demands for quality meat products.