Rising Incidence of Urolithiasis

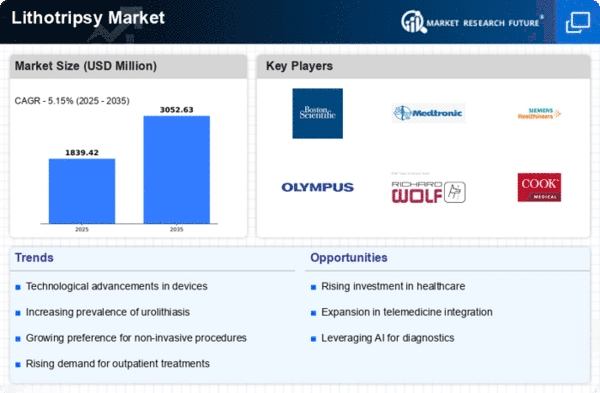

The increasing prevalence of urolithiasis, or kidney stones, is a primary driver of the Global Lithotripsy Market Industry. As reported, approximately 10% of the global population experiences kidney stones at some point in their lives. This condition is particularly prevalent in developed nations, where lifestyle factors contribute to its rise. The demand for effective treatment options, such as lithotripsy, is expected to grow as more individuals seek medical intervention. Consequently, the Global Lithotripsy Market Industry is projected to reach 3.32 USD Billion in 2024, reflecting the urgent need for advanced lithotripsy technologies.

Growing Awareness and Patient Education

The rise in awareness regarding kidney health and the importance of timely treatment for kidney stones is propelling the Global Lithotripsy Market Industry. Educational campaigns by healthcare organizations and government initiatives are informing the public about the risks associated with untreated urolithiasis. This heightened awareness is likely to lead to increased patient consultations and a subsequent rise in lithotripsy procedures. As more patients seek effective treatments, the market is expected to expand, contributing to the projected growth of the Global Lithotripsy Market Industry, which is set to reach 5.48 USD Billion by 2035.

Technological Advancements in Lithotripsy

Technological innovations in lithotripsy equipment are significantly enhancing treatment efficacy and patient outcomes, thus driving the Global Lithotripsy Market Industry. The introduction of more precise and less invasive lithotripsy devices, such as laser lithotripsy systems, allows for improved stone fragmentation and reduced recovery times. These advancements not only increase the appeal of lithotripsy as a treatment option but also expand its applications in various clinical settings. As a result, the market is anticipated to grow at a compound annual growth rate of 4.67% from 2025 to 2035, indicating a robust future for the Global Lithotripsy Market Industry.

Regulatory Support and Reimbursement Policies

Supportive regulatory frameworks and favorable reimbursement policies are crucial drivers of the Global Lithotripsy Market Industry. Governments and health insurance providers are increasingly recognizing the cost-effectiveness of lithotripsy as a treatment option for kidney stones. This recognition leads to improved reimbursement rates for lithotripsy procedures, making them more accessible to patients. As reimbursement policies evolve to support innovative treatment modalities, the market is likely to see an uptick in lithotripsy utilization. This trend underscores the importance of regulatory support in fostering growth within the Global Lithotripsy Market Industry.

Aging Population and Increased Healthcare Access

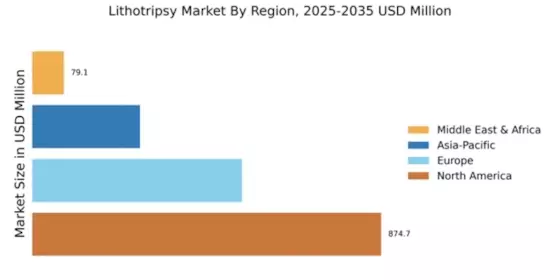

The aging global population is a significant factor influencing the Global Lithotripsy Market Industry. Older adults are more susceptible to developing kidney stones due to various physiological changes and comorbidities. As healthcare access improves in many regions, more elderly patients are likely to seek treatment for urolithiasis. This demographic shift is expected to drive demand for lithotripsy services, as healthcare providers adapt to the needs of an aging population. The Global Lithotripsy Market Industry stands to benefit from this trend, as the number of procedures performed is likely to increase in response to the growing patient base.