Rising Adoption of Renewable Energy Sources

The Lithium Ion Solar Energy Storage Market is significantly influenced by the increasing adoption of renewable energy sources. As nations strive to meet their climate goals, the shift towards solar energy has become more pronounced. In 2025, solar energy accounts for a substantial portion of new energy installations, with projections indicating that solar capacity could reach over 1,000 GW. This growing reliance on solar energy necessitates efficient storage solutions to manage energy supply and demand effectively. Lithium-ion batteries are particularly well-suited for this purpose, as they can store excess energy generated during peak sunlight hours for use during periods of low generation. This trend not only supports energy independence but also enhances grid stability, making lithium-ion storage an essential component of the renewable energy landscape.

Government Policies and Financial Incentives

The Lithium Ion Solar Energy Storage Market is bolstered by favorable government policies and financial incentives aimed at promoting renewable energy adoption. Many governments are implementing tax credits, rebates, and grants to encourage the installation of solar energy systems coupled with energy storage solutions. As of 2025, various countries have introduced legislation that mandates a certain percentage of energy to be sourced from renewables, further driving the demand for lithium-ion storage systems. These policies not only lower the initial investment costs for consumers but also enhance the return on investment for solar energy projects. Consequently, the synergy between government support and market growth is likely to propel the lithium-ion storage market forward, making it a critical player in the transition to sustainable energy.

Increasing Energy Storage Needs for Grid Stability

The Lithium Ion Solar Energy Storage Market is increasingly recognized for its role in enhancing grid stability. As the penetration of intermittent renewable energy sources like solar increases, the need for reliable energy storage solutions becomes paramount. In 2025, energy storage systems are projected to play a crucial role in balancing supply and demand, particularly during peak usage times. Lithium-ion batteries offer rapid response times and high efficiency, making them ideal for grid applications. Utilities are investing in large-scale lithium-ion storage projects to mitigate the risks associated with grid fluctuations and to ensure a stable energy supply. This trend indicates a growing recognition of the importance of energy storage in maintaining grid reliability and resilience.

Technological Innovations in Energy Storage Solutions

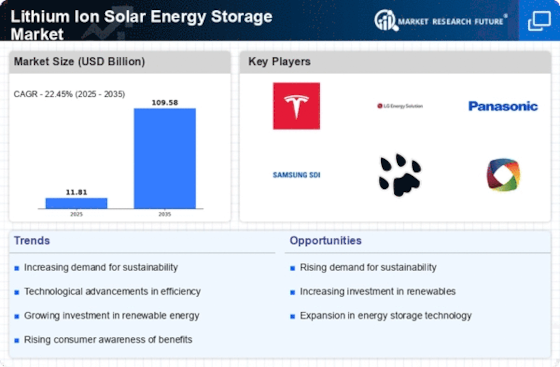

The Lithium Ion Solar Energy Storage Market is experiencing a surge in technological innovations that enhance battery performance and efficiency. Recent advancements in battery chemistry, such as the development of solid-state batteries, are poised to revolutionize energy storage capabilities. These innovations not only improve energy density but also extend the lifespan of batteries, making them more appealing to consumers and businesses alike. As of 2025, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 20%, driven by these technological enhancements. Furthermore, the integration of smart technologies in energy management systems allows for better monitoring and optimization of energy usage, thereby increasing the overall efficiency of solar energy systems.

Consumer Awareness and Demand for Sustainable Solutions

The Lithium Ion Solar Energy Storage Market is witnessing a shift in consumer behavior towards sustainable energy solutions. As awareness of climate change and environmental issues grows, consumers are increasingly seeking ways to reduce their carbon footprint. In 2025, a significant percentage of homeowners and businesses are expected to invest in solar energy systems paired with lithium-ion storage to achieve energy independence and sustainability. This rising demand is not only driven by environmental concerns but also by the economic benefits associated with energy savings and potential revenue from selling excess energy back to the grid. The convergence of consumer awareness and technological advancements is likely to propel the lithium-ion storage market, making it a vital component of the broader transition to a sustainable energy future.