-

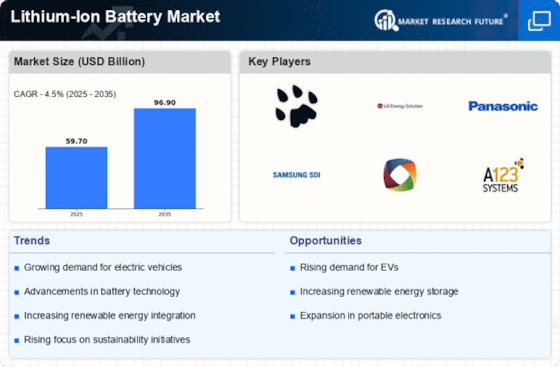

EXECUTIVE SUMMARY

-

MARKET ATTRACTIVENESS ANALYSIS

- Lithium Ion Battery Market, BY TYPE

- Lithium Ion Battery Market, BY POWER CAPACITY

- Lithium Ion Battery Market, BY VOLTAGE

- Lithium Ion Battery Market, BY END USER

- Lithium Ion Battery Market, BY REGION

-

MARKET INTRODUCTION

-

DEFINITION

-

SCOPE OF THE STUDY

-

MARKET STRUCTURE

-

RESEARCH METHODOLOGY

-

RESEARCH PROCESS

-

PRIMARY RESEARCH

-

SECONDARY RESEARCH

-

MARKET SIZE ESTIMATION

-

TOP DOWN & BOTTOM-UP APPROACH

-

FORECAST MODEL

-

LIST OF ASSUMPTIONS

-

MARKET INSIGHTS

-

MARKET DYNAMICS

-

INTRODUCTION

-

DRIVERS

- INCREASING PENETRATION INTO LARGE APPLICATIONS

- GROWING DEMAND FOR HIGH POWER AND HIGH CAPACITY LITHIUM-ION BATTERIES IN ELECTRIC VEHICLES

- DRIVERS IMPACT ANALYSIS

-

RESTRAINTS

- HIGH PRICE OF LITHIUM-ION BATTERIES

- RESTRAINTS IMPACT ANALYSIS

-

OPPORTUNITIES

- GROWING APPLICATIONS IN THE ENERGY SECTOR

-

IMPACT ANALYSIS OF COVID-19 ON LITHIUM-ION BATTERY MARKET

- IMPACT ON OVERALL LITHIUM-ION BATTERY INDUSTRY

- IMPACT ON SUPPLY CHAIN OF LITHIUM-ION BATTERY

- IMPACT ON MARKET DEMAND OF LITHIUM-ION BATTERY

- IMPACT ON PRICING OF LITHIUM-ION BATTERY

-

MARKET FACTOR ANALYSIS

-

SUPPLY/VALUE CHAIN ANALYSIS

- DESIGN & DEVELOPMENT

- RAW MATERIAL/ COMPONENT SUPPLY

- MANUFACTURING & ASSEMBLY

- SALES & DISTRIBUTION

- END-USERS

-

PORTER’S FIVE FORCES MODEL

- THREAT OF NEW ENTRANTS

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF BUYERS

- THREAT OF SUBSTITUTES

- INTENSITY OF RIVALRY

-

Lithium Ion Battery Market, BY TYPE

-

OVERVIEW

-

LITHIUM NICKEL MANGANESE COBALT

- LITHIUM NICKEL MANGANESE COBALT: MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION/COUNTRY, 2024-2032

-

LITHIUM IRON PHOSPHATE

- LITHIUM IRON PHOSPHATE: MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION/COUNTRY, 2024-2032

-

LITHIUM COBALT OXIDE

- LITHIUM COBALT OXIDE: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

LITHIUM TITANATE OXIDE

- LITHIUM TITANATE OXIDE: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

LITHIUM MANGANESE OXIDE

- LITHIUM MANGANESE OXIDE: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

LITHIUM NICKEL COBALT ALUMINUM OXIDE

- LITHIUM NICKEL COBALT ALUMINUM OXIDE: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

Lithium Ion Battery Market, BY POWER CAPACITY

-

OVERVIEW

-

UP TO 3,000 MAH

- UP TO 3,000 MAH: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

3,000 MAH-10,000 MAH

- 3,000 MAH-10,000 MAH: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

10,000 MAH-60,000 MAH

- 10,000 MAH-60,000 MAH: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

ABOVE 60,000 MAH

- ABOVE 60,000 MAH: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

Lithium Ion Battery Market, BY VOLTAGE

-

OVERVIEW.

-

UP TO 12V

- UP TO 12V: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

12V-36V

- 12V-36V: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

ABOVE 36V

- ABOVE 36V: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

Lithium Ion Battery Market, BY END USER

-

OVERVIEW

-

AEROSPACE

- AEROSPACE: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

MOBILITY / RECREATIONAL

- MOBILITY / RECREATIONAL: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

MARINE

- MARINE: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

POWER TOOLS

- POWER TOOLS: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

LAWN AND GARDEN

- LAWN AND GARDEN: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

E-BIKES/SCOOTERS

- E-BIKES/SCOOTERS: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

SMALL EV’S (GOLF CARTS, FORKLIFTS, DELIVERY VEHICLES)

- SMALL EV’S (GOLF CARTS, FORKLIFTS, DELIVERY VEHICLES): MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

ENERGY STORAGE

- ENERGY STORAGE: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

MOTORCYCLES

- MOTORCYCLES: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

DRONE

- DRONE: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

OTHERS

- OTHERS: MARKET ESTIMATES & FORECAST BY REGION/COUNTRY, 2024-2032

-

Lithium Ion Battery Market, BY REGION

-

OVERVIEW

-

NORTH AMERICA

- U.S.

- CANADA

- MEXICO

-

EUROPE

- GERMANY

- FRANCE.

- U.K.

- SPAIN

- ITALY

- REST OF EUROPE

-

ASIA PACIFIC

- CHINA

- INDIA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC

-

SOUTH AMERICA

- BRAZIL

- ARGENTINA

- REST OF SOUTH AMERICA

-

MIDDLE EAST & AFRICA

- SAUDI ARABIA

- UAE

- SOUTH AFRICA

- REST OF MIDDLE EAST & AFRICA

-

COMPETITIVE LANDSCAPE

-

COMPETITIVEOVERVIEW

-

COMPETITIVE BENCHMARKING

-

MARKET SHARE ANALYSIS

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

- NEW PRODUCT LAUNCH/SERVICE DEPLOYMENT

- MERGER & ACQUISITION

- JOINT VENTURES

-

COMPANY PROFILES

-

HITACHI, LTD

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

JOHNSON CONTROLS

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

LITHIUM WERKS

- COMPANY OVERVIEW

- FINNACIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

PANASONIC CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

LG CHEM

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

SAMSUNG SDI CO LTD

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

TOSHIBA CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

GS YUASA LITHIUM POWER

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

BYD CO LTD

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

SONY CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS

- SWOT ANALYSIS

-

A123 SYSTEMS LLC

- COMPANY OVERVIEW

- PRODUCTS OFFERINGS

- SWOT ANALYSIS

- KEY STRATEGIES

-

AESC (AUTOMOTIVE ENERGY SUPPLY CORPORATION)

- COMPANY OVERVIEW

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

BEIJING PRIDE POWER (BPP)

- COMPANY OVERVIEW

- SWOT ANALYSIS

-

BAK GROUP

- COMPANY OVERVIEW

- SWOT ANALYSIS

-

LI-TEC BATTERY GMBH

- COMPANY OVERVIEW

- SWOT ANALYSIS

-

APPENDIX

-

REFERENCES

-

RELATED REPORTS

-

-

LIST OF TABLES

-

LIST OF ASSUMPTIONS

-

GLOBAL LITHIUM-ION BATTERY MARKET ESTIMATES & Lithium Ion Battery Market, BY TYPE, 2024-2032 (USD BILLION)

-

LITHIUM NICKEL MANGANESE COBALT MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

LITHIUM IRON PHOSPHATE ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

LITHIUM COBALT OXIDE MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

LITHIUM TITANATE OXIDE MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

LITHIUM MANGANESE OXIDE MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

LITHIUM NICKEL COBALT ALUMINUM OXIDE MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

GLOBAL LITHIUM-ION BATTERY MARKET ESTIMATES & Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032 (USD BILLION)

-

UP TO 3,000 MAH MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

3,000 MAH-10,000 MAH MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

10,000 MAH-60,000 MAH MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

ABOVE 60,000 MAH MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

GLOBAL LITHIUM-ION BATTERY MARKET ESTIMATES & Lithium Ion Battery Market, BY VOLTAGE, 2024-2032 (USD BILLION)

-

UP TO 12V MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

12V-36V MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

ABOVE 36V MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

GLOBAL LITHIUM-ION BATTERY MARKET ESTIMATES & Lithium Ion Battery Market, BY END USE, 2024-2032 (USD BILLION)

-

AEROSPACE MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

MOBILITY / RECREATIONAL MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

MARINE MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

POWER TOOLS MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

LAWN AND GARDEN MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

E-BIKES/SCOOTERS MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

SMALL EV’S (GOLF CARTS, FORKLIFTS, DELIVERY VEHICLES) MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

ENERGY STORAGE MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

MOTORCYCLES MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

DRONE MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

OTHERS MARKET ESTIMATES & Lithium Ion Battery Market, BY REGION, 2024-2032 (USD BILLION)

-

Lithium Ion Battery Market, BY REGION, 2024-2032(USD BILLION)

-

NORTH AMERICA: Lithium Ion Battery Market, BY COUNTRY, 2024-2032(USD BILLION)

-

NORTH AMERICA: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

NORTH AMERICA: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

NORTH AMERICA: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

NORTH AMERICA: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

U.S.: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

U.S.: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

U.S.: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

U.S.: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

CANADA: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

CANADA: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

CANADA: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

CANADA: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

MEXICO: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

MEXICO: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

MEXICO: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

MEXICO: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

EUROPE: Lithium Ion Battery Market, BY COUNTRY, 2018-2027(USD BILLION)

-

EUROPE: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

EUROPE: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

EUROPE: Lithium Ion Battery Market, BY VOLTAGES, 2024-2032(USD BILLION)

-

EUROPE: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

GERMANY: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

GERMANY: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

GERMANY: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

GERMANY: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

FRANCE.: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

FRANCE.: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

FRANCE.: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

FRANCE: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

U.K: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

U.K: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

U.K: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

U.K: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

SPAIN: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

SPAIN: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

SPAIN: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

SPAIN: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

ITALY: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

ITALY: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

ITALY: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

ITALY: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

REST OF EUROPE: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

REST OF EUROPE: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

REST OF EUROPE: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

REST OF EUROPE: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

ASIA PACIFIC: Lithium Ion Battery Market, BY COUNTRY, 2024-2032(USD BILLION)

-

ASIA PACIFIC: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

ASIA PACIFIC: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

ASIA PACIFIC: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

ASIA PACIFIC: Lithium Ion Battery Market, BY END-USERS, 2024-2032(USD BILLION)

-

CHINA: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

CHINA: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

CHINA: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

CHINA: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

INDIA: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

INDIA: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

INDIA: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

INDIA: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

JAPAN: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

JAPAN: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

JAPAN: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

JAPAN: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

SOUTH KOREA: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

SOUTH KOREA: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

SOUTH KOREA: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

SOUTH KOREA: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

AUSTRALIA: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

AUSTRALIA: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

AUSTRALIA: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

AUSTRALIA: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

REST OF ASIA PACIFIC: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

REST OF ASIA PACIFIC: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

REST OF ASIA PACIFIC: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

REST OF ASIA PACIFIC: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

SOUTH AMERICA: Lithium Ion Battery Market, BY REGION, 2024-2032(USD BILLION)

-

SOUTH AMERICA: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

SOUTH AMERICA: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

SOUTH AMERICA: Lithium Ion Battery Market, BY VOLTAGES, 2024-2032(USD BILLION)

-

SOUTH AMERICA: Lithium Ion Battery Market, BY END-USER, 2024-2032(USD BILLION)

-

BRAZIL: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

BRAZIL: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

BRAZIL: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

BRAZIL: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

ARGENTINA: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

ARGENTINA: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

ARGENTINA: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

ARGENTINA: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

REST OF SOUTH AMERICA: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

REST OF SOUTH AMERICA: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

REST OF SOUTH AMERICA: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

REST OF SOUTH AMERICA: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

MIDDLE EAST & AFRICA: Lithium Ion Battery Market, BY COUNTRIES, 2024-2032(USD BILLION)

-

MIDDLE EAST & AFRICA: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

MIDDLE EAST & AFRICA: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

MIDDLE EAST & AFRICA: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

MIDDLE EAST & AFRICA: Lithium Ion Battery Market, BY END-USER, 2024-2032(USD BILLION)

-

SAUDI ARABIA: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

SAUDI ARABIA: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

SAUDI ARABIA: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

SAUDI ARABIA: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

UAE: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

UAE: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

UAE: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

UAE: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

SOUTH AFRICA: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

SOUTH AFRICA: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

SOUTH AFRICA: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

SOUTH AFRICA: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

REST OF MIDDLE EAST & AFRICA: Lithium Ion Battery Market, BY TYPE, 2024-2032(USD BILLION)

-

REST OF MIDDLE EAST & AFRICA: Lithium Ion Battery Market, BY POWER CAPACITY, 2024-2032(USD BILLION)

-

REST OF MIDDLE EAST & AFRICA: Lithium Ion Battery Market, BY VOLTAGE, 2024-2032(USD BILLION)

-

REST OF MIDDLE EAST & AFRICA: Lithium Ion Battery Market, BY END USER, 2024-2032(USD BILLION)

-

NEW PRODUCT LAUNCH/SERVICE DEPLOYMENT

-

MERGER & ACQUISITION

-

JOINT VENTURES

-

HITACHI, LTD: PRODUCTS OFFERINGS

-

HITACHI, LTD: KEY DEVELOPMENTS

-

JOHNSON CONTROLS: PRODUCTS OFFERINGS

-

JOHNSON CONTROLS: KEY DEVELOPMENTS

-

LITHIUM WERKS: PRODUCTS OFFERINGS

-

LITHIUM WERKS: KEY DEVELOPMENTS

-

PANASONIC CORPORATION: PRODUCTS OFFERINGS

-

PANASONIC CORPORATION: KEY DEVELOPMENTS

-

LG CHEM LTD: PRODUCTS OFFERINGS

-

LG CHEM LTD: KEY DEVELOPMENTS

-

SAMSUNG SDI CO LTD COMPANY: PRODUCTS OFFERINGS

-

SAMSUNG SDI CO LTD COMPANY: KEY DEVELOPMENTS

-

TOSHIBA CORPORATION: PRODUCTS OFFERINGS

-

TOSHIBA CORPORATION: KEY DEVELOPMENTS

-

GS YUASA LITHIUM POWER COMPANY: PRODUCTS OFFERINGS

-

GS YUASA LITHIUM POWER COMPANY: KEY DEVELOPMENTS

-

BYD COMPANY LTD COMPANY: PRODUCTS OFFERINGS

-

BYD COMPANY LTD COMPANY: KEY DEVELOPMENTS

-

SONY CORPORATION: PRODUCTS OFFERINGS

-

A123 SYSTEMS LLC: PRODUCTS OFFERINGS

-

AESC: PRODUCTS OFFERINGS

-

AESC (AUTOMOTIVE ENERGY SUPPLY CORPORATION): KEY DEVELOPMENTS

-

-

LIST OF FIGURES

-

MARKET SYNOPSIS

-

MARKET ATTRACTIVENESS ANALYSIS: GLOBAL LITHIUM-ION BATTERY MARKET

-

GLOBAL LITHIUM-ION BATTERY MARKET ANALYSIS BY TYPE

-

GLOBAL LITHIUM-ION BATTERY MARKET ANALYSIS BY POWER CAPACITY

-

GLOBAL LITHIUM-ION BATTERY MARKET ANALYSIS BY VOLTAGE

-

GLOBAL LITHIUM-ION BATTERY MARKET ANALYSIS BY END USER

-

GLOBAL LITHIUM-ION BATTERY MARKET ANALYSIS BY REGION

-

GLOBAL LITHIUM-ION BATTERY MARKET: MARKET STRUCTURE

-

RESEARCH PROCESS OF MRFR

-

NORTH AMERICA MARKET SIZE & MARKET SHARE BY COUNTRY (2024 VS 2032)

-

EUROPE MARKET SIZE & MARKET SHARE BY COUNTRY (2024 VS 2032)

-

ASIA-PACIFIC & MARKET SHARE BY COUNTRY (2024 VS 2032)

-

MIDDLE EAST & AFRICA MARKET SIZE & MARKET SHARE BY COUNTRY (2024 VS 2032)

-

SOUTH AMERICA MARKET SIZE & MARKET SHARE BY COUNTRY (2024 VS 2032)

-

DROC ANALYSIS OF GLOBAL LITHIUM-ION BATTERY MARKET

-

DRIVERS IMPACT ANALYSIS: LITHIUM-ION BATTERY MARKET

-

RESTRAINTS IMPACT ANALYSIS: LITHIUM-ION BATTERY MARKET

-

SUPPLY / VALUE CHAIN: GLOBAL LITHIUM-ION BATTERYMARKET

-

Lithium Ion Battery Market, BY TYPE, 2021 (% SHARE)

-

Lithium Ion Battery Market, BY TYPE, 2024 TO 2032 (USD BILLION)

-

Lithium Ion Battery Market, BY POWER CAPACITY, 2021 (% SHARE)

-

Lithium Ion Battery Market, BY POWER CAPACITY, 2024 TO 2032 (USD BILLION)

-

Lithium Ion Battery Market, BY VOLTAGE, 2021 (% SHARE)

-

Lithium Ion Battery Market, BY VOLTAGE, 2024 TO 2032 (USD BILLION)

-

Lithium Ion Battery Market, BY END USER, 2021 (% SHARE)

-

Lithium Ion Battery Market, BY END USER, 2024 TO 2032 (USD BILLION)

-

Lithium Ion Battery Market, BY REGION, 2024 TO 2032(USD BILLION)

-

Lithium Ion Battery Market, BY REGION, 2021 (% SHARE)

-

NORTH AMERICA: Lithium Ion Battery Market, BY COUNTRY, 2021 (% SHARE)

-

EUROPE: Lithium Ion Battery Market, BY COUNTRY, 2021 (% SHARE)

-

ASIA PACIFIC: Lithium Ion Battery Market, BY COUNTRY, 2021 (% SHARE)

-

SOUTH AMERICA: Lithium Ion Battery Market, BY COUNTRY, 2021 (% SHARE)

-

MIDDLE EAST & AFRICA: Lithium Ion Battery Market, BY COUNTRY, 2021 (% SHARE)

-

BENCHMARKING OF MAJOR COMPETITORS

-

MAJOR MANUFACTURER MARKET SHARE ANALYSIS, 2020

-

HITACHI, LTD: FINANCIAL OVERVIEW SNAPSHOT

-

HITACHI, LTD: SWOT ANALYSIS

-

JOHNSON CONTROLS: FINANCIAL OVERVIEW SNAPSHOT

-

JOHNSON CONTROLS: SWOT ANALYSIS

-

LITHIUM WERKS: SWOT ANALYSIS

-

PANASONIC CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

PANASONIC CORPORATION: SWOT ANALYSIS

-

LG CHEM LTD: FINANCIAL OVERVIEW SNAPSHOT

-

LG CHEM LTD: SWOT ANALYSIS

-

SAMSUNG SDI CO LTD COMPANY: FINANCIAL OVERVIEW SNAPSHOT

-

SAMSUNG SDI CO LTD COMPANY: SWOT ANALYSIS

-

TOSHIBA CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

TOSHIBA CORPORATIONSSS: SWOT ANALYSIS

-

GS YUASA LITHIUM POWER COMPANY: FINANCIAL OVERVIEW SNAPSHOT

-

GS YUASA LITHIUM POWER COMPANY: SWOT ANALYSIS

-

BYD COMPANY LTD COMPANY: FINANCIAL OVERVIEW SNAPSHOT

-

BYD COMPANY LTD COMPANY: SWOT ANALYSIS

-

SONY CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

SONY CORPORATION: SWOT ANALYSIS

-

A123 SYSTEMS LLC: SWOT ANALYSIS

-

AESC (AUTOMOTIVE ENERGY SUPPLY CORPORATION): SWOT ANALYSIS

-

BEIJING PRIDE POWER (BPP): SWOT ANALYSIS

-

BAK GROUP: SWOT ANALYSIS

-

LI-TEC BATTERY GMBH: SWOT ANALYSIS

-

'

Leave a Comment