Growing Energy Storage Applications

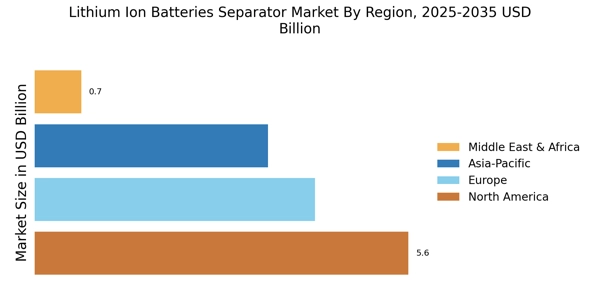

The expansion of energy storage applications is a significant driver for the Lithium Ion Batteries Separator Market. With the increasing integration of renewable energy sources, such as solar and wind, the need for efficient energy storage systems has become paramount. Lithium-ion batteries are favored for their high energy density and efficiency, making them ideal for energy storage solutions. In 2025, the energy storage market is projected to grow substantially, with lithium-ion batteries accounting for a significant share. This trend is likely to boost the demand for high-quality separators that enhance battery performance and longevity. Consequently, the Lithium Ion Batteries Separator Market is expected to benefit from the rising need for reliable energy storage solutions.

Rising Demand for Electric Vehicles

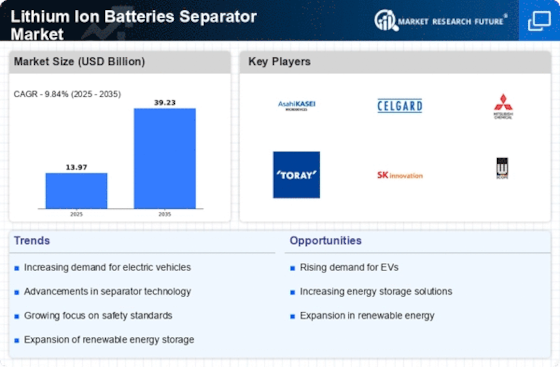

The increasing adoption of electric vehicles (EVs) is a primary driver for the Lithium Ion Batteries Separator Market. As consumers and manufacturers alike shift towards sustainable transportation solutions, the demand for high-performance lithium-ion batteries has surged. In 2025, the EV market is projected to grow at a compound annual growth rate of approximately 20%, necessitating advanced battery technologies. This growth directly influences the separator market, as separators are crucial for battery efficiency and safety. The need for lightweight, durable, and thermally stable separators is becoming more pronounced, thereby propelling innovations in separator materials and designs. Consequently, the Lithium Ion Batteries Separator Market is likely to experience significant expansion, driven by the burgeoning EV sector.

Technological Innovations in Battery Design

Technological advancements in battery design are significantly impacting the Lithium Ion Batteries Separator Market. Innovations such as solid-state batteries and advanced liquid electrolytes are creating new opportunities for separator manufacturers. These technologies require separators that can withstand higher voltages and temperatures, leading to increased research and development efforts. The market for separators is expected to grow as manufacturers seek to enhance battery performance and safety. In 2025, the market for lithium-ion battery separators is anticipated to reach a valuation of several billion dollars, reflecting the critical role of separators in next-generation battery technologies. As a result, the Lithium Ion Batteries Separator Market is poised for growth, driven by the demand for cutting-edge battery solutions.

Increased Focus on Recycling and Sustainability

The growing emphasis on recycling and sustainability is emerging as a key driver for the Lithium Ion Batteries Separator Market. As environmental concerns rise, manufacturers are increasingly seeking ways to minimize waste and enhance the recyclability of battery components. This trend is prompting innovations in separator materials that are not only efficient but also environmentally friendly. In 2025, the market for recycled lithium-ion batteries is expected to expand, creating opportunities for separator manufacturers to develop sustainable solutions. The focus on sustainability is likely to influence the design and production of separators, ensuring they meet both performance and environmental standards. Thus, the Lithium Ion Batteries Separator Market is positioned to grow in response to the increasing demand for sustainable battery technologies.

Regulatory Support for Clean Energy Initiatives

Regulatory frameworks supporting clean energy initiatives are influencing the Lithium Ion Batteries Separator Market. Governments worldwide are implementing policies aimed at reducing carbon emissions and promoting renewable energy technologies. These regulations often include incentives for electric vehicles and energy storage systems, which in turn drive the demand for lithium-ion batteries. As a result, the need for efficient and safe battery separators is becoming increasingly critical. In 2025, the regulatory landscape is expected to further evolve, potentially leading to stricter standards for battery performance and safety. This regulatory support is likely to create a favorable environment for the Lithium Ion Batteries Separator Market, encouraging innovation and investment in separator technologies.