Integration of AI and Analytics

The integration of artificial intelligence and advanced analytics into storage solutions is transforming the Life sciences Enterprise Storage Market. Organizations are increasingly leveraging AI to optimize data management, enhance storage efficiency, and derive actionable insights from vast datasets. The ability to analyze large volumes of data in real-time is becoming essential for research and development processes. As a result, storage providers are developing AI-driven solutions that not only store data but also facilitate intelligent data processing and retrieval. This trend is expected to drive innovation in the market, as companies seek to harness the power of AI to improve their operational capabilities.

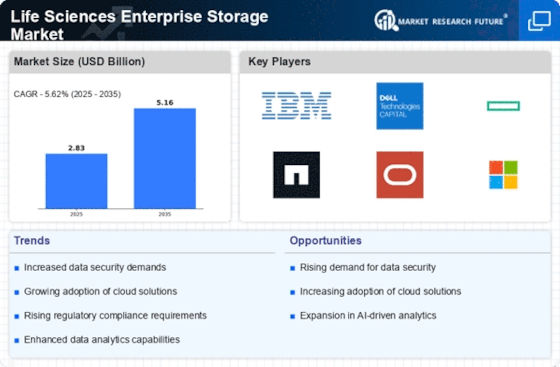

Increased Focus on Data Security

Data security remains a paramount concern within the Life sciences Enterprise Storage Market. With the rise in cyber threats and data breaches, organizations are compelled to adopt stringent security measures to protect sensitive information. Regulatory bodies are enforcing compliance standards that require life sciences companies to implement advanced security protocols. As a result, there is a growing demand for storage solutions that incorporate encryption, access controls, and data loss prevention features. The market for secure storage solutions is projected to grow significantly, as organizations prioritize safeguarding their intellectual property and patient data, thus propelling the overall market.

Rising Data Volume in Life Sciences

The Life sciences Enterprise Storage Market is experiencing a surge in data volume due to advancements in research methodologies and technologies. As the industry increasingly relies on high-throughput sequencing, clinical trials, and patient data management, the demand for robust storage solutions escalates. It is estimated that the data generated in life sciences could reach several zettabytes in the coming years. This exponential growth necessitates scalable storage solutions that can accommodate vast amounts of data while ensuring quick access and retrieval. Consequently, organizations are investing in enterprise storage systems that offer high capacity, reliability, and performance, thereby driving the market forward.

Advancements in Cloud Storage Solutions

The Life sciences Enterprise Storage Market is witnessing a notable shift towards cloud storage solutions. The flexibility, scalability, and cost-effectiveness of cloud services are appealing to life sciences organizations that require dynamic storage capabilities. According to recent estimates, the cloud storage segment is expected to capture a substantial share of the market, driven by the need for collaborative research and data sharing among global teams. Cloud solutions facilitate seamless access to data from various locations, enhancing operational efficiency. As more organizations migrate to cloud-based storage, the demand for innovative cloud storage solutions is likely to increase, further stimulating market growth.

Regulatory Compliance and Data Management

Regulatory compliance is a critical driver in the Life sciences Enterprise Storage Market. Organizations are required to adhere to stringent regulations regarding data management, storage, and sharing. Compliance with standards such as HIPAA and FDA guidelines necessitates the implementation of robust storage solutions that ensure data integrity and traceability. As regulatory scrutiny intensifies, life sciences companies are investing in enterprise storage systems that can provide comprehensive audit trails and reporting capabilities. This focus on compliance not only enhances data governance but also drives the demand for specialized storage solutions tailored to meet regulatory requirements, thereby influencing market dynamics.