Growing Focus on Drug Development

The Life Science Chemical Biotech Instrumentation Market is significantly influenced by the growing focus on drug development. Pharmaceutical companies are increasingly investing in biotechnological research to discover and develop new therapeutics. This trend is expected to drive the demand for specialized instrumentation that can facilitate various stages of drug development, including screening, analysis, and quality control. According to recent estimates, The Life Science Chemical Biotech Instrumentation Market is anticipated to reach USD 1.5 trillion by 2025, which underscores the potential for growth in the instrumentation sector. As regulatory requirements become more stringent, the need for reliable and efficient instruments will likely intensify, further propelling the market forward.

Emergence of Personalized Medicine

The Life Science Chemical Biotech Instrumentation Market is witnessing a transformative shift towards personalized medicine. This approach tailors medical treatment to individual characteristics, needs, and preferences, necessitating advanced instrumentation for accurate diagnostics and treatment monitoring. The rise of personalized medicine is expected to create substantial opportunities for instrumentation manufacturers, as they develop tools that can analyze genetic information and biomarker profiles. The market for personalized medicine is projected to grow significantly, with estimates suggesting it could reach USD 2.5 trillion by 2030. This growth will likely drive demand for innovative instruments that can support the development and implementation of personalized therapies.

Increased Investment in Biotechnology

The Life Science Chemical Biotech Instrumentation Market is benefiting from increased investment in biotechnology. Governments and private entities are recognizing the potential of biotechnology to address pressing health and environmental challenges. This influx of funding is likely to enhance research capabilities and stimulate the development of new instrumentation. For instance, venture capital investments in biotech firms have surged, with reports indicating a rise of over 30% in funding over the past year. Such financial support is expected to foster innovation in instrumentation, leading to the introduction of more advanced and efficient tools that cater to the evolving needs of researchers and clinicians.

Rising Demand for Advanced Research Tools

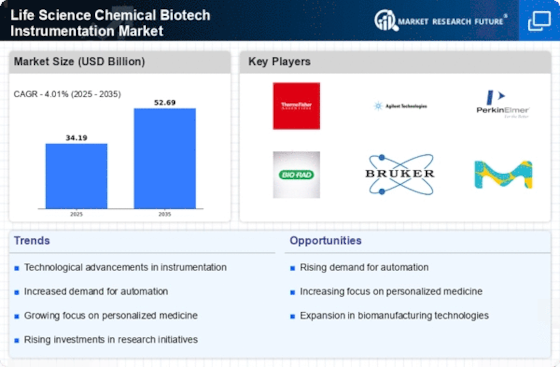

The Life Science Chemical Biotech Instrumentation Market is experiencing a notable increase in demand for advanced research tools. This surge is primarily driven by the need for precision and accuracy in scientific research. As researchers strive to develop innovative solutions in fields such as genomics and proteomics, the requirement for sophisticated instrumentation becomes paramount. The market is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years, reflecting the increasing investment in research and development activities. Furthermore, the integration of cutting-edge technologies, such as high-throughput screening and mass spectrometry, is likely to enhance the capabilities of existing instruments, thereby attracting more researchers to adopt these advanced tools.

Collaboration Between Academia and Industry

The Life Science Chemical Biotech Instrumentation Market is being shaped by the increasing collaboration between academia and industry. Partnerships between universities and biotech companies are fostering knowledge transfer and innovation, leading to the development of new instrumentation solutions. These collaborations often result in the creation of cutting-edge technologies that can be commercialized, thereby enhancing the market landscape. As academic institutions continue to focus on applied research, the demand for specialized instruments that can support these initiatives is likely to grow. This trend not only benefits the instrumentation market but also accelerates the pace of scientific discovery and technological advancement.

Leave a Comment