Economic Growth

Economic growth is a fundamental driver impacting the Life Reinsurance Market. As economies expand, disposable incomes tend to rise, leading to increased spending on insurance products, including life insurance. This correlation suggests that a robust economic environment can stimulate demand for reinsurance services, as primary insurers seek to expand their portfolios. Recent economic forecasts indicate that many regions are poised for steady growth, which could translate into higher premiums for life insurance products. Additionally, as businesses grow, they may seek to mitigate risks associated with employee benefits and pensions, further driving demand for life reinsurance solutions. The Life Reinsurance Market, therefore, stands to benefit from favorable economic conditions, as increased consumer confidence and spending power may lead to a more vibrant insurance landscape.

Aging Population

The aging population is a significant driver influencing the Life Reinsurance Market. As life expectancy continues to rise, there is an increasing demand for life insurance products that cater to older demographics. This demographic shift necessitates innovative reinsurance solutions that address the unique needs of aging individuals, such as long-term care and retirement planning. According to demographic studies, the proportion of individuals aged 65 and older is expected to reach 20% by 2030 in many regions, creating a substantial market opportunity for reinsurers. Consequently, the Life Reinsurance Market must adapt its product offerings to accommodate this growing segment, potentially leading to increased premiums and enhanced profitability. Moreover, reinsurers may collaborate with primary insurers to develop tailored products that address the specific health and financial concerns of older clients.

Regulatory Changes

The Life Reinsurance Market is currently experiencing a wave of regulatory changes that could reshape its landscape. Governments are increasingly focusing on enhancing consumer protection and ensuring financial stability within the insurance sector. For instance, the introduction of Solvency II regulations in various regions mandates that reinsurers maintain adequate capital reserves, thereby influencing their operational strategies. This regulatory scrutiny may lead to increased compliance costs, but it also encourages more robust risk management practices. As a result, reinsurers are likely to adapt their offerings to align with these evolving regulations, potentially leading to a more resilient Life Reinsurance Market. Furthermore, the emphasis on transparency and accountability may foster greater trust among consumers, which could enhance market growth in the long term.

Increased Risk Awareness

Increased risk awareness among consumers and businesses is driving changes in the Life Reinsurance Market. As individuals become more cognizant of the financial implications of unforeseen events, there is a growing demand for comprehensive life insurance coverage. This heightened awareness is partly fueled by the proliferation of information through digital platforms, which has made consumers more informed about their options. Consequently, reinsurers are likely to see an uptick in demand for their services as primary insurers seek to offer more robust life insurance products. Furthermore, the Life Reinsurance Market may experience a shift towards more customized solutions that address specific risks faced by different demographic groups. This trend could lead to increased competition among reinsurers, prompting them to innovate and enhance their service offerings to meet evolving consumer expectations.

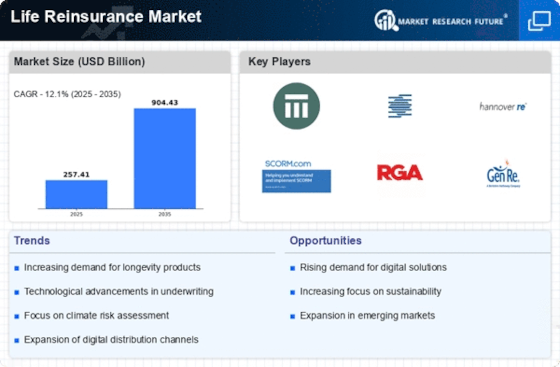

Technological Advancements

Technological advancements are playing a pivotal role in shaping the Life Reinsurance Market. The integration of artificial intelligence and big data analytics is enabling reinsurers to enhance their underwriting processes and risk assessment capabilities. For example, the use of predictive modeling allows for more accurate pricing of reinsurance products, which can lead to improved profitability. Additionally, the adoption of blockchain technology is streamlining claims processing and enhancing data security, thereby reducing operational inefficiencies. According to recent estimates, the global investment in insurtech is projected to reach USD 10 billion by 2025, indicating a strong trend towards digital transformation in the Life Reinsurance Market. This technological evolution not only improves operational efficiency but also enhances customer experience, potentially attracting new clients and expanding market share.