Aging Population and Increased Longevity

The aging population is a significant driver of the Life Insurance Market, as longer life expectancy leads to a higher demand for life insurance products. With advancements in healthcare and lifestyle changes, individuals are living longer, which necessitates financial planning for extended lifespans. According to demographic studies, the proportion of individuals aged 65 and older is projected to increase substantially in the coming years. This demographic shift indicates a growing market for life insurance, as older adults seek to secure their financial legacy and ensure their families are protected. Consequently, insurers are adapting their offerings to cater to this demographic, thereby expanding the Life Insurance Market.

Increasing Awareness of Financial Security

The growing awareness of the need for financial security is a pivotal driver in the Life Insurance Market. As individuals become more cognizant of the uncertainties associated with life events, the demand for life insurance products is likely to rise. Recent surveys indicate that approximately 60% of adults recognize the importance of having life insurance as a safety net for their families. This trend suggests that consumers are increasingly prioritizing financial planning, which in turn propels the growth of the Life Insurance Market. Furthermore, educational initiatives by insurance companies and financial advisors are enhancing public understanding of life insurance benefits, thereby fostering a more informed consumer base.

Rising Disposable Income and Affordability

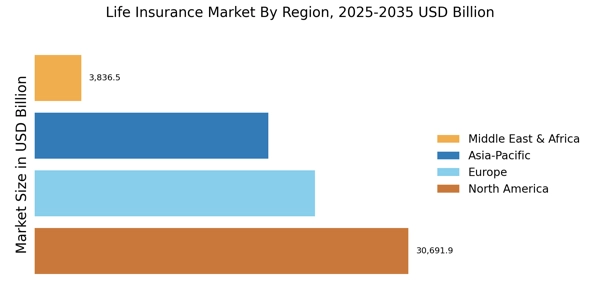

Rising disposable income levels are contributing to the growth of the Life Insurance Market, as consumers are increasingly able to allocate funds towards insurance products. As economies recover and expand, individuals are more willing to invest in life insurance as part of their financial planning. Market data suggests that regions experiencing economic growth are witnessing a corresponding increase in life insurance penetration rates. This trend indicates that as people become more financially secure, they are more likely to consider life insurance as a viable option for safeguarding their families' futures. Consequently, the Life Insurance Market is poised for growth as affordability becomes less of a barrier for potential policyholders.

Regulatory Changes and Compliance Requirements

Regulatory changes play a crucial role in shaping the Life Insurance Market. Governments worldwide are implementing stricter compliance requirements to enhance consumer protection and ensure transparency in insurance practices. These regulations often mandate clearer disclosures and fair treatment of policyholders, which can influence consumer trust and purchasing decisions. As insurers adapt to these evolving regulations, they may need to invest in compliance infrastructure and training, which could impact operational costs. However, these changes also present opportunities for insurers to differentiate themselves by demonstrating their commitment to ethical practices, potentially leading to increased market share within the Life Insurance Market.

Technological Advancements in Insurance Solutions

Technological advancements are transforming the Life Insurance Market, enabling insurers to offer more efficient and customer-centric solutions. Innovations such as artificial intelligence and big data analytics are streamlining underwriting processes and enhancing risk assessment capabilities. For instance, the integration of telematics and wearable technology allows insurers to gather real-time health data, which can lead to personalized policy offerings. This shift towards technology-driven solutions is not only improving customer experience but also increasing operational efficiency. As a result, the Life Insurance Market is witnessing a surge in new product development, catering to the evolving needs of consumers who seek convenience and tailored services.