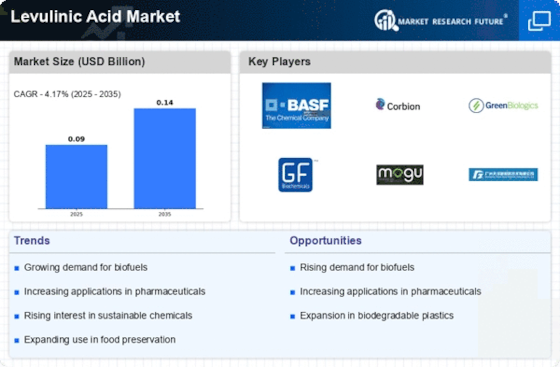

Top Industry Leaders in the Levulinic Acid Market

Beneath the buzzword of sustainability and the allure of renewable chemicals, lies a hidden battlefield – the levulinic acid market. this versatile chemical, derived from biomass like corncobs and woodchips, promises a greener future for pharmaceuticals, plastics, and even cosmetics. However, within this seemingly noble realm, a fierce competition unfolds, where established players and nimble startups vie for dominance with diverse strategies and a constant eye on innovation. Let's delve into the factors shaping market share, industry news, and recent developments that paint a vibrant picture of this dynamic world.

Beneath the buzzword of sustainability and the allure of renewable chemicals, lies a hidden battlefield – the levulinic acid market. this versatile chemical, derived from biomass like corncobs and woodchips, promises a greener future for pharmaceuticals, plastics, and even cosmetics. However, within this seemingly noble realm, a fierce competition unfolds, where established players and nimble startups vie for dominance with diverse strategies and a constant eye on innovation. Let's delve into the factors shaping market share, industry news, and recent developments that paint a vibrant picture of this dynamic world.

Key Players and Adopted Strategies:

-

GFBiochemicals Ltd. (UK): This pioneer leverages its first-mover advantage and proprietary technology to secure a significant market share. Their focus on high-purity levulinic acid and technical expertise attracts premium customers in demanding sectors like pharmaceuticals and fine chemicals. -

Merck KGaA (Germany): Renowned for innovation, Merck capitalizes on its R&D prowess to develop novel levulinic acid derivatives with enhanced functionalities like improved biodegradability and targeted drug delivery. Their emphasis on niche applications like green solvents and agrochemicals drives market differentiation. -

Tokyo Chemical Industry Co., Ltd. (Japan): A leading manufacturer of industrial chemicals, Tokyo Chemical focuses on cost optimization and volume deals. Their readily available options and competitive pricing strengthen their position in price-sensitive sectors like polymers and plasticizers. -

Ascender Chemical Co.,Ltd. (China): This rising player utilizes its domestic presence and government support to control a sizable market share. Their focus on customized levulinic acid solutions and partnerships with regional distributors caters to the burgeoning Asian market. -

Heroy Chemical Industry (India): A leading manufacturer of specialty chemicals, Heroy focuses on sustainability and green technologies. Their emphasis on bio-based feedstocks and closed-loop production resonates with environmentally conscious consumers and regulatory bodies.

Factors Shaping Market Share:

-

Sustainability Concerns: Growing demand for eco-friendly alternatives to petroleum-based chemicals drives the market for levulinic acid as a platform chemical for diverse applications. -

Technological Advancements: Development of new biorefining technologies, catalytic processes, and efficient downstream conversion methods expands the application range and cost-effectiveness of levulinic acid. -

Downstream Applications: Growth in key industries like pharmaceuticals, cosmetics, bioplastics, and agrochemicals drives the demand for specific levulinic acid derivatives and functionalities. -

Regulatory Landscape: Stringent regulations on plastic waste and carbon emissions incentivize the use of bio-based chemicals like levulinic acid across various sectors. -

Cost Optimization: Efficient production processes, minimizing feedstock usage, and offering competitive pricing are crucial for profitability in a price-sensitive market.

Key Companies in the Levulinic Acid market include

-

G.F. Biochemicals Ltd. (Italy)

-

Langfang Triple Well Chemicals Co. Ltd (China)

-

Biofine International Inc. (U.S.)

-

Avantium (Netherlands)

-

Simagchem Corporation (China)

-

Hefei TNJ Chemical Industry Co., Ltd. (China)

-

CSPC Pharmaceutical Group (China)

-

Great Chemicals Co. Ltd. (China)

-

Anhui Herman Impex Co Ltd (China)

-

DuPont (U.S.)

-

The Valspar Corporation (U.S.)

-

KCC Corporation (South Korea)

-

Sherwin-Williams (U.S.)

-

AkzoNobel (Netherlands)

-

Jotun A/S (Norway)

Recent Developments:

-

August 2023: Tokyo Chemical introduces a closed-loop recycling system for levulinic acid byproducts, minimizing waste and reducing production costs. -

October 2023: A startup unveils a novel biorefinery technology that converts biomass directly into levulinic acid and other valuable chemicals, potentially disrupting traditional production methods. -

November 2023: Merck collaborates with leading research institutions to develop levulinic acid-based agrochemicals for targeted pest control and improved crop yields. -

December 2023: GFBiochemicals and Ascender Chemical partner with regional distributors and manufacturers to create a global supply chain for levulinic acid