Global Trade Growth

The expansion of global trade is a vital driver for the Global Less Than Container Load Market LCL Market Industry. As countries engage in more international trade, the demand for flexible shipping solutions increases. LCL shipping provides an effective means for businesses to access global markets without the need for large shipments. This trend is particularly pronounced in emerging economies, where trade volumes are rising. The market is anticipated to reach 100 USD Billion by 2035, underscoring the importance of LCL services in facilitating international commerce. Companies are likely to capitalize on this growth by enhancing their LCL offerings to meet the evolving needs of global trade.

Rising E-commerce Demand

The surge in e-commerce activities globally appears to be a primary driver for the Global Less Than Container Load Market LCL Market Industry. As online shopping continues to expand, businesses increasingly require flexible shipping solutions to accommodate smaller shipments. This trend is particularly evident in regions with high online retail growth, such as North America and Asia-Pacific. The Global LCL market is projected to reach 74.4 USD Billion in 2024, reflecting the need for efficient logistics services that cater to diverse consumer demands. Companies are likely to leverage LCL shipping to optimize costs and enhance delivery speed, thereby supporting the overall market growth.

Market Growth Projections

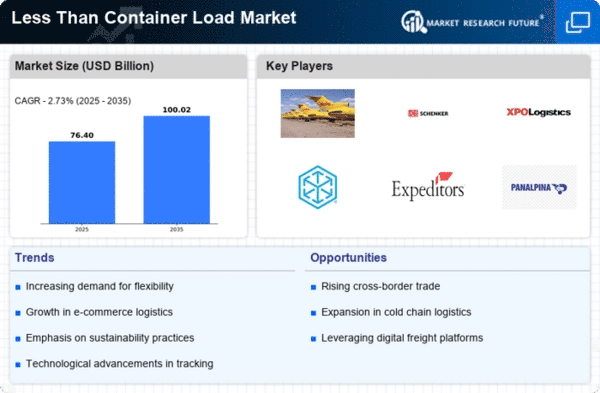

The Global Less Than Container Load Market LCL Market Industry is poised for substantial growth, with projections indicating a market size of 74.4 USD Billion in 2024 and an anticipated increase to 100 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 2.73% from 2025 to 2035. Such figures highlight the increasing reliance on LCL shipping solutions as businesses seek to optimize logistics and meet the demands of a dynamic global marketplace. The upward trend in market size reflects the evolving nature of shipping practices and the growing importance of LCL services in facilitating international trade.

Cost Efficiency in Shipping

Cost efficiency remains a crucial factor influencing the Global Less Than Container Load Market LCL Market Industry. Businesses are increasingly seeking ways to minimize shipping expenses while maintaining service quality. LCL shipping offers a viable solution by allowing companies to share container space, thus reducing costs associated with unused capacity. This approach is particularly beneficial for small and medium-sized enterprises that may not have enough volume to justify full container loads. As a result, the market is expected to grow steadily, with a projected CAGR of 2.73% from 2025 to 2035, indicating a sustained interest in cost-effective shipping solutions.

Technological Advancements in Logistics

Technological advancements are transforming the logistics landscape, significantly impacting the Global Less Than Container Load Market LCL Market Industry. Innovations such as real-time tracking, automated warehousing, and data analytics enhance operational efficiency and improve customer satisfaction. Companies are increasingly adopting these technologies to streamline their supply chains and optimize LCL shipping processes. For instance, the integration of artificial intelligence in logistics management systems allows for better demand forecasting and inventory management. As these technologies become more prevalent, they are likely to drive growth in the LCL market, facilitating a more responsive and agile shipping environment.

Environmental Sustainability Initiatives

Environmental sustainability initiatives are becoming increasingly relevant in the Global Less Than Container Load Market LCL Market Industry. As businesses strive to reduce their carbon footprints, LCL shipping presents an opportunity to optimize resource utilization. By consolidating shipments, companies can minimize the number of containers needed, thereby reducing emissions associated with transportation. This focus on sustainability aligns with global trends toward greener logistics practices. As regulations and consumer preferences shift toward environmentally friendly solutions, the LCL market is expected to adapt, potentially leading to innovations in sustainable shipping practices that further drive market growth.