North America : Education Leader in Legal Training

North America leads the Legal and Paralegal Education and Training Services Market, holding a significant market share of 5.0 in 2024. The growth is driven by increasing demand for legal professionals, regulatory support for online education, and a rise in paralegal roles across various sectors. The region's educational institutions are adapting to technological advancements, enhancing accessibility and flexibility for students.

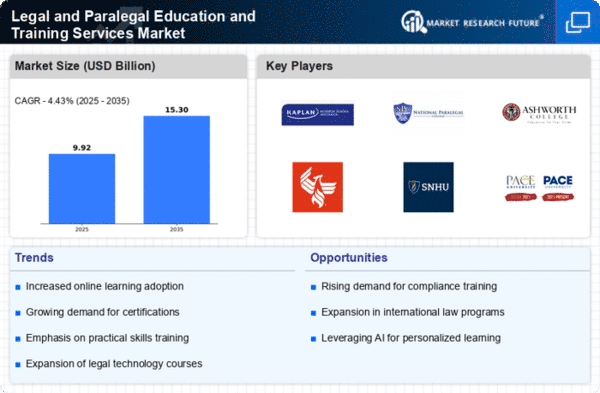

The United States is the primary player in this market, with key institutions like Kaplan Inc, University of Phoenix, and George Washington University shaping the landscape. The competitive environment is characterized by a mix of traditional universities and online platforms, catering to diverse learning needs. This dynamic fosters innovation and ensures a steady supply of qualified legal professionals to meet market demands.

Europe : Growing Market with Diverse Needs

Europe's Legal and Paralegal Education and Training Services Market is valued at 2.5, reflecting a growing interest in legal studies across the continent. Factors such as increasing legal complexities, a rise in regulatory requirements, and a focus on professional development are driving demand. The region is witnessing a shift towards online and blended learning models, making legal education more accessible to a broader audience.

Leading countries like the UK, Germany, and France are at the forefront, with numerous institutions offering specialized programs. The competitive landscape includes both established universities and emerging online platforms. This diversity allows for tailored educational offerings that meet the specific needs of various legal sectors, ensuring a robust pipeline of skilled professionals. "The legal education sector is evolving to meet the demands of a changing workforce," states the European Commission.

Asia-Pacific : Emerging Market with Potential

The Asia-Pacific region, with a market size of 1.8, is witnessing a burgeoning interest in legal and paralegal education. Factors such as economic growth, increasing legal awareness, and the globalization of legal practices are driving this trend. Regulatory bodies are also promoting legal education to enhance the quality of legal services in the region, contributing to its growth.

Countries like Australia, India, and Japan are leading the charge, with a mix of traditional universities and online education providers. The competitive landscape is evolving, with institutions adapting to the needs of a diverse student population. This growth presents opportunities for both local and international players to establish a foothold in the market, catering to the rising demand for legal professionals.

Middle East and Africa : Developing Market with Challenges

The Middle East and Africa region, with a market size of 0.2, is in the early stages of developing its Legal and Paralegal Education and Training Services Market. Factors such as increasing legal complexities and a growing emphasis on professional qualifications are beginning to drive demand. However, challenges such as limited access to quality education and varying regulatory frameworks persist, hindering rapid growth.

Countries like South Africa and the UAE are making strides in enhancing legal education, with initiatives aimed at improving standards and accessibility. The competitive landscape is still emerging, with a mix of local institutions and international partnerships. As the region continues to develop, there is potential for growth in legal education services, addressing the needs of a changing legal environment.