Research Methodology on Leap Engine Market

The research process implemented for this report is structured for enabling increased accuracy in the market-related information used for the development of the report. It is necessary to use a structured and comprehensive research process to ensure that all the factors affecting the market are aptly considered for product segmentation within the market.

Primary Research

To derive data from the primary research process, numerous interviews are conducted with important industry experts from the market. The depth of the interview process is based on the primary questions that were developed in the research process, specifically related to the Leap Engine market.

Moreover, interviews are conducted on an expert level, to gain additional information on the past, present and the potential future of the market. This primary factor enables qualitative and quantitative analysis of the market with further insight into the past, current and potential future statistical information.

Secondary Research

For the categorization of data associated with the global Leap Engine market, there were numerous second research sources. These sources aid the researchers in the progression of the market data collection and decoding of the same. Several types of industry-related documents, white papers, market share analyses, media releases, financial records, and other relevant sources have been used for the decisions that were finalized. Moreover, analysts at Market Research Future investigated the pricing of the market and identified the factors essential for the growth of the market, which enabled the accumulation of market data from a range of sources.

Market synthesis:

Synthesizing the collected and derived data from primary and secondary sources is essential for the compilation and reproduction of a cohesive report. The market synthesis process results in cohesive and concise interpretations and conclusions. This process also aids in the calculation of the various parameters used for measuring the market and gaining information associated with the development of the Leap Engine market.

Market breakdown and market data triangulation:

For increasing the accuracy of the report, a sequential testing mechanism is implanted. This method allows the triangulation of data. To reach a predicted CAGR, the study took into account the information gathered from various sources. The sources exploited for this have been independent market traders and cloud mining operators, which provide tangible data over the years.

Scope of the study:

The scope of the research report on the Leap Engine Market is the overall market definition, the major drivers and inhibitors, the past and present development trends, segment analysis, and the potential growth opportunities of the Leap Engine Market.

The objective of the study:

This research report on the Leap Engine Market seeks to provide an overview of the current and future status of the market specific to the products and services available in the industry, as well as their market potential. The research report also seeks to establish the status of key players within the market and their respective strategies, and the market potentials, developments and current and future trends. The report also aims to identify the major limitations, trends, opportunities and potential risks associated with the Leap Engine Market.

Research design:

The research design for this research report on Leap Engine Market comprises the various steps that were taken for collecting, assessing and analyzing data and information from different sources. The research activity also included a chronology of the market as well as segmentation, product categorization and comparison. In addition, the research has taken into account the latest product launches and developments by key players in the market for assessing the current and future market potentials.

Research assumptions:

The assumptions made for the research activity are based on the current and future market developments, the product and services availability and the overall product potentials within the Leap Engine Market. The assumptions have enabled us to draw constructive conclusions, acquire an in-depth understanding and gain useful quantitative as well as qualitative insights into the Leap Engine Market.

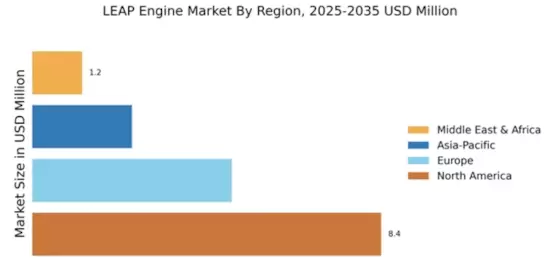

Geographical scope:

The geographical scope of this report on the Leap Engine Market is limited to the United States, Canada, Mexico, Brazil, Argentina, India, the UK, Germany, France, Italy, Russia, South Africa, Saudi Arabia, UAE, and the rest of Europe.

Segment information:

The research report has segregated the global Leap Engine Market into different market segments with the most significant ones being application and product type. The segmentation allows for a detailed view of the market potentially aiding in decision-making processes.

Latest Comments

leap engine market