Increasing Crime Rates

The Global Law Enforcement Software Market Industry is experiencing growth due to rising crime rates across various regions. As urbanization continues to expand, law enforcement agencies are increasingly adopting advanced software solutions to enhance their operational efficiency. For instance, cities with higher crime rates are investing in predictive policing tools, which utilize data analytics to forecast criminal activity. This trend is expected to drive the market's value to approximately 20.2 USD Billion in 2024, as agencies seek to leverage technology to combat crime effectively.

Technological Advancements

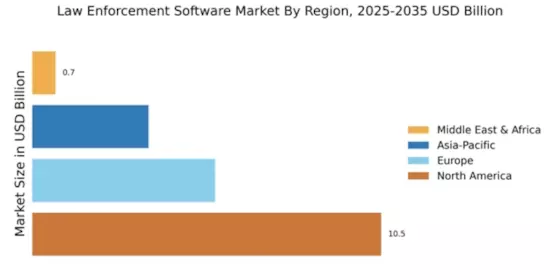

Rapid advancements in technology are significantly influencing the Global Law Enforcement Software Market Industry. Innovations such as artificial intelligence, machine learning, and big data analytics are being integrated into law enforcement software, enabling agencies to process vast amounts of data efficiently. These technologies facilitate real-time decision-making and improve investigative processes. As a result, the market is projected to grow at a CAGR of 7.35% from 2025 to 2035, potentially reaching 44.1 USD Billion by 2035. This growth reflects the increasing reliance on technology to enhance public safety.

Public Demand for Transparency

There is a growing public demand for transparency and accountability in law enforcement, which is influencing the Global Law Enforcement Software Market Industry. Citizens are increasingly advocating for the use of technology that promotes transparency in policing practices, such as body-worn cameras and data management systems. These tools not only enhance accountability but also improve community relations. As law enforcement agencies respond to these demands, the adoption of software solutions that facilitate transparency is likely to increase, further propelling market growth.

Government Initiatives and Funding

Government initiatives aimed at enhancing public safety are driving the Global Law Enforcement Software Market Industry. Various governments are allocating substantial budgets to modernize law enforcement agencies and improve their technological capabilities. For example, federal grants and funding programs are being established to support the acquisition of advanced software solutions. This financial backing encourages law enforcement agencies to invest in innovative technologies, thereby fostering market growth. The anticipated increase in government spending is expected to contribute significantly to the market's expansion in the coming years.

Integration of Cloud-Based Solutions

The integration of cloud-based solutions is transforming the Global Law Enforcement Software Market Industry. Cloud technology offers law enforcement agencies the ability to store and access data securely while facilitating collaboration among different departments. This shift towards cloud computing enhances operational efficiency and reduces costs associated with traditional IT infrastructure. As more agencies recognize the benefits of cloud solutions, the market is expected to witness a significant uptick in adoption rates, contributing to its overall growth trajectory.