Emphasis on Public Safety

The emphasis on public safety in China significantly influences the law enforcement software market. With rising urbanization and population density, the demand for effective law enforcement solutions has surged. The Chinese government has prioritized public safety initiatives, leading to increased funding for law enforcement technology. In 2025, the budget allocated for public safety technology was projected to exceed 2 billion USD, indicating a robust commitment to enhancing law enforcement capabilities. This focus on safety not only drives the adoption of innovative software solutions but also fosters collaboration between government agencies and technology providers, thereby stimulating market growth.

Growing Cybersecurity Threats

The growing cybersecurity threats in China are increasingly shaping the law enforcement software market. As cybercrime becomes more sophisticated, law enforcement agencies are compelled to adopt advanced cybersecurity solutions to protect sensitive data and maintain public trust. In 2025, the market for cybersecurity solutions within law enforcement was estimated to reach 800 million USD, reflecting the urgent need for robust protective measures. This trend suggests that as threats evolve, law enforcement agencies will likely invest more in software that enhances their cybersecurity posture, thereby driving growth in the overall market.

Rise of Smart City Initiatives

The rise of smart city initiatives in China is a significant driver of the law enforcement software market. As cities evolve into smart ecosystems, the integration of technology in public safety becomes paramount. Smart city projects often incorporate advanced surveillance systems, real-time data sharing, and predictive policing technologies. By 2025, investments in smart city technologies were projected to surpass 10 billion USD, with a substantial portion allocated to law enforcement applications. This trend indicates that as cities become smarter, the demand for sophisticated law enforcement software will likely increase, fostering innovation and collaboration among technology providers.

Integration of Advanced Analytics

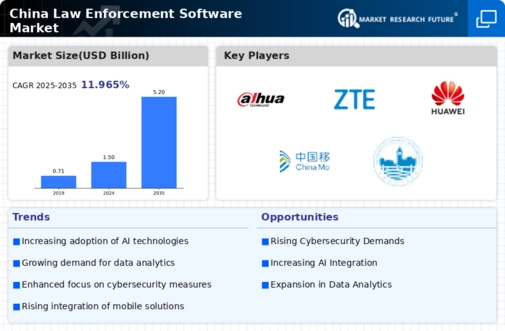

The integration of advanced analytics into the China law enforcement software market appears to be a pivotal driver. Law enforcement agencies are increasingly leveraging data analytics to enhance decision-making processes and operational efficiency. By analyzing vast amounts of data, agencies can identify crime patterns, allocate resources more effectively, and improve response times. In 2025, the market for analytics-driven law enforcement solutions in China was estimated to reach approximately 1.5 billion USD, reflecting a growing recognition of the value of data-driven insights. This trend suggests that as agencies adopt more sophisticated analytical tools, the overall effectiveness of law enforcement operations may improve, thereby driving further investment in the sector.

Regulatory Compliance and Standards

Regulatory compliance and standards play a crucial role in shaping the China law enforcement software market. The Chinese government has established stringent regulations governing data privacy and security, compelling law enforcement agencies to adopt compliant software solutions. As of January 2026, compliance with the Cybersecurity Law and other relevant regulations is mandatory for all law enforcement software providers. This regulatory landscape creates a demand for software that not only meets operational needs but also adheres to legal requirements. Consequently, companies that can demonstrate compliance are likely to gain a competitive edge, driving innovation and investment in the market.