Aging Population

The demographic shift towards an aging population in South America is likely to have a profound impact on the aesthetics market. As life expectancy increases, there is a growing desire among older adults to maintain a youthful appearance. This trend is particularly evident in countries like Chile and Brazil, where the proportion of individuals aged 60 and above is projected to rise significantly. Market data indicates that this demographic is increasingly seeking non-invasive and minimally invasive aesthetic procedures, which are perceived as safer and more accessible. The aesthetics market may see a surge in demand for treatments such as Botox and dermal fillers, as older consumers prioritize their appearance. This shift suggests that businesses in the aesthetics market will need to tailor their offerings to meet the specific needs of this demographic, potentially leading to innovative product development and service delivery.

Influence of Social Media

The impact of social media on the aesthetics market in South America cannot be overstated. Platforms such as Instagram and TikTok have transformed how beauty and aesthetics are perceived, creating a culture of instant gratification and visual appeal. Influencers and celebrities often showcase their aesthetic enhancements, which can lead to increased consumer interest in similar procedures. Recent studies indicate that around 40% of individuals aged 18-34 in South America are influenced by social media when considering aesthetic treatments. This trend suggests that the aesthetics market may continue to grow as social media platforms serve as powerful marketing tools for clinics and practitioners. The ability to share before-and-after results online enhances consumer trust and encourages potential clients to seek out aesthetic services, thereby driving market expansion.

Growing Middle-Class Affluence

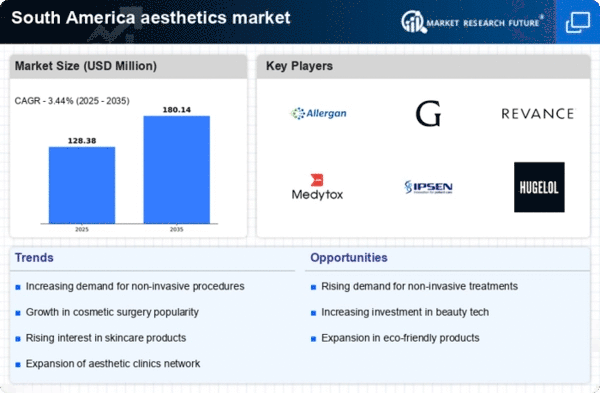

The rise of the middle class in South America appears to be a pivotal driver for the aesthetics market. As disposable incomes increase, more individuals are likely to invest in personal care and aesthetic treatments. Reports indicate that the middle-class population in countries like Brazil and Argentina has expanded significantly, leading to a greater demand for aesthetic services. This demographic shift suggests that the aesthetics market could experience a compound annual growth rate (CAGR) of around 8% over the next five years. The growing affluence allows consumers to prioritize their appearance, thereby fueling the demand for both surgical and non-surgical procedures. Consequently, businesses in the aesthetics market are likely to adapt their offerings to cater to this emerging consumer base, enhancing their service portfolios to include a wider range of aesthetic solutions.

Regulatory Changes and Accessibility

Regulatory frameworks governing the aesthetics market in South America are evolving, which could enhance accessibility to aesthetic treatments. Governments are increasingly recognizing the economic potential of the aesthetics industry and are implementing policies that facilitate the establishment of clinics and training programs. For instance, recent legislative changes in Brazil have streamlined the licensing process for aesthetic practitioners, making it easier for new entrants to join the market. This increased accessibility may lead to a broader range of services being offered at competitive prices, thereby attracting a larger consumer base. Market analysts suggest that as regulations become more favorable, the aesthetics market could experience accelerated growth, with an expected increase in the number of clinics and practitioners by approximately 15% over the next few years. This trend indicates a promising future for the aesthetics market in South America.

Cultural Emphasis on Beauty Standards

Cultural perceptions of beauty in South America play a crucial role in shaping the aesthetics market. Societal norms often place a high value on physical appearance, which drives individuals to seek aesthetic enhancements. In countries like Colombia and Brazil, beauty pageants and media portrayals reinforce these ideals, leading to increased consumer interest in aesthetic procedures. Data suggests that approximately 30% of women in urban areas have considered or undergone some form of aesthetic treatment. This cultural emphasis on beauty not only stimulates demand but also encourages innovation within the aesthetics market, as providers strive to meet the evolving preferences of consumers. As a result, the market is likely to see a diversification of services that align with local beauty standards, further propelling growth in the sector.

Leave a Comment