Rising Demand in Research Laboratories

The Laboratory Vacuum Pumps Market is experiencing a notable increase in demand, primarily driven by the expansion of research laboratories across various sectors. As scientific research continues to evolve, the need for efficient and reliable vacuum systems becomes paramount. In 2025, the market is projected to witness a growth rate of approximately 5.2%, reflecting the increasing investments in research and development. This trend is particularly evident in pharmaceuticals and biotechnology, where vacuum pumps are essential for processes such as distillation and filtration. The growing emphasis on innovative research methodologies further propels the demand for advanced laboratory vacuum pumps, indicating a robust future for the industry.

Increased Focus on Environmental Regulations

The Laboratory Vacuum Pumps Market is also shaped by the heightened focus on environmental regulations and sustainability practices. As industries strive to minimize their ecological footprint, the demand for energy-efficient and environmentally friendly vacuum pumps is on the rise. In 2025, it is anticipated that the market for eco-friendly laboratory vacuum pumps will expand significantly, driven by regulatory pressures and consumer preferences for sustainable solutions. This shift not only aligns with global sustainability goals but also encourages manufacturers to innovate and develop products that meet these standards. Thus, the emphasis on environmental compliance is likely to be a key driver for growth in the laboratory vacuum pumps market.

Growing Adoption of Automation in Laboratories

The Laboratory Vacuum Pumps Market is increasingly influenced by the growing adoption of automation technologies in laboratories. As laboratories seek to enhance productivity and reduce human error, the integration of automated systems becomes essential. Vacuum pumps play a critical role in automated processes, such as sample preparation and material handling. By 2025, it is estimated that the market for automated laboratory equipment, including vacuum pumps, will experience a significant uptick, driven by the need for efficiency and precision. This trend suggests that the laboratory vacuum pumps market will continue to evolve, adapting to the demands of modern laboratory environments.

Technological Innovations in Vacuum Pump Design

The Laboratory Vacuum Pumps Market is witnessing a surge in technological innovations that enhance the performance and efficiency of vacuum pumps. Recent advancements in materials and design have led to the development of more compact, lightweight, and energy-efficient models. These innovations are particularly appealing to laboratories seeking to optimize their operations while reducing energy consumption. In 2025, the market is expected to benefit from these technological advancements, with a projected increase in the adoption of smart vacuum systems that integrate with laboratory automation. This trend indicates a shift towards more sophisticated solutions, positioning the laboratory vacuum pumps market for sustained growth.

Expansion of Pharmaceutical and Biotechnology Sectors

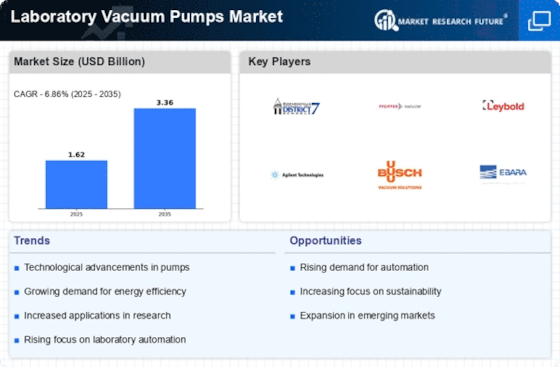

The Laboratory Vacuum Pumps Market is significantly influenced by the expansion of the pharmaceutical and biotechnology sectors. These industries require high-quality vacuum systems for various applications, including drug formulation and quality control processes. As of 2025, the pharmaceutical sector is expected to grow at a compound annual growth rate (CAGR) of around 6.5%, which directly correlates with the rising demand for laboratory vacuum pumps. The increasing focus on drug development and the need for stringent quality assurance measures necessitate the use of reliable vacuum systems. Consequently, this growth trajectory suggests a promising outlook for the laboratory vacuum pumps market, driven by the evolving needs of these critical sectors.