North America : Market Leader in Chemicals

North America continues to lead the Laboratory Chemicals Operations Support Market, holding a significant market share of 2.6B in 2024. The region's growth is driven by robust R&D activities, increasing demand for high-quality laboratory chemicals, and stringent regulatory standards that ensure safety and efficacy. The presence of advanced infrastructure and a strong focus on innovation further catalyze market expansion.

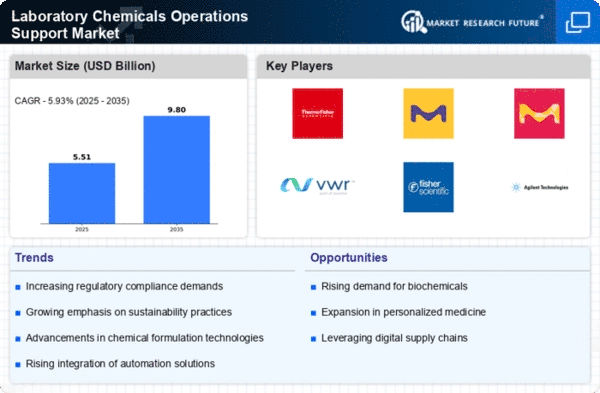

The United States is the primary contributor to this market, with key players like Thermo Fisher Scientific, Sigma-Aldrich, and Agilent Technologies dominating the landscape. The competitive environment is characterized by continuous advancements in technology and product offerings, ensuring that North America remains at the forefront of laboratory chemical operations. The region's commitment to research and development solidifies its position as a global leader.

Europe : Emerging Market Dynamics

Europe's Laboratory Chemicals Operations Support Market is valued at 1.5B, reflecting a growing demand driven by increasing investments in healthcare and biotechnology sectors. Regulatory frameworks, such as REACH, promote the safe use of chemicals, enhancing market growth. The region is witnessing a shift towards sustainable practices, with a focus on eco-friendly chemicals and processes, which is expected to further boost market dynamics.

Germany and the UK are leading countries in this market, with major players like Merck KGaA and VWR International establishing a strong foothold. The competitive landscape is marked by collaborations and partnerships aimed at innovation and efficiency. As the market evolves, companies are increasingly focusing on meeting regulatory requirements while enhancing product offerings to cater to diverse customer needs.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region, with a market size of 1.0B, is rapidly emerging as a significant player in the Laboratory Chemicals Operations Support Market. The growth is fueled by increasing industrialization, rising healthcare expenditures, and a growing emphasis on research and development. Countries like China and India are investing heavily in laboratory infrastructure, which is expected to drive demand for laboratory chemicals in the coming years.

China is the largest market in the region, with a competitive landscape featuring both local and international players. Companies like Avantor and PerkinElmer are expanding their presence to capture the growing demand. The region's focus on innovation and technology adoption is paving the way for new product developments, making it a key area for future growth in laboratory chemicals.

Middle East and Africa : Niche Market Opportunities

The Middle East and Africa region, with a market size of 0.1B, presents niche opportunities in the Laboratory Chemicals Operations Support Market. The growth is primarily driven by increasing investments in healthcare and research sectors, alongside a rising demand for quality laboratory chemicals. Regulatory bodies are beginning to implement standards that promote safety and efficacy, which is expected to enhance market growth in the region.

Countries like South Africa and the UAE are leading the way in developing their laboratory infrastructure. The competitive landscape is still emerging, with a few key players starting to establish their presence. As the region continues to develop, there is potential for significant growth in laboratory chemicals, particularly as investments in research and development increase.