Top Industry Leaders in the Kombucha Market

Strategies Adopted by Kombucha Key Players

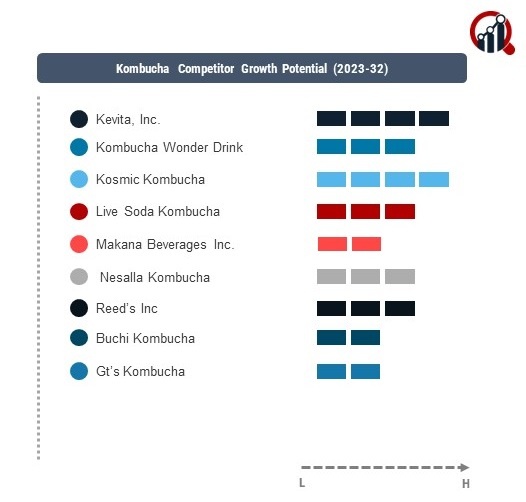

The competitive landscape of the Kombucha market is marked by intense rivalry among key players vying for a larger share in this rapidly growing industry.

Key players such as

- Kevita, Inc. (Canada)

- Kombucha Wonder Drink(U.S.)

- Gt’s Kombucha (U.S.)

- Nesalla Kombucha (U.S.)

- Reed’s Inc. (U.S.)

- Buchi Kombucha (U.S.)

- Kosmic Kombucha (U.S.)

- Live Soda Kombucha (U.S.)

- Makana Beverages Inc. (U.S.)

Strategies adopted by these key players include aggressive marketing campaigns, product diversification, and geographical expansion. GT's Living Foods, for instance, has consistently focused on product innovation, introducing new flavors and formulations to cater to evolving consumer preferences. KeVita, on the other hand, has strategically expanded its distribution channels, securing shelf space in major retail outlets to increase accessibility.

Market Share Analysis Factors:

Market share analysis in the Kombucha industry is influenced by several factors. Brand recognition and loyalty play a crucial role, with consumers often gravitating towards established names they trust. Additionally, pricing strategies, product quality, and effective marketing contribute to a brand's market share. Key players invest significantly in research and development to enhance the nutritional profile of their products, meeting the demand for healthier beverage options.

New & Emerging Companies:

As the market matures, new and emerging companies are making their presence felt, challenging established players. Small-batch producers like Revive Kombucha and Buchi Kombucha are gaining traction, capitalizing on the trend towards artisanal and locally sourced products. These companies often focus on unique flavor profiles and sustainable practices to carve a niche for themselves in the competitive landscape.

Industry Trends:

Industry news and current company investment trends shed light on the dynamism of the Kombucha market. Investment in production facilities, distribution networks, and marketing campaigns is a common theme among key players. Additionally, partnerships and collaborations with retailers and influencers are being increasingly leveraged to expand market reach. In 2023, notable investments were witnessed in automated brewing technologies, allowing companies to scale production efficiently.

Competitive Scenario:

The overall competitive scenario is characterized by a balance between established giants and nimble newcomers. While large players dominate shelf space in major retail chains, smaller producers find success in local and specialty markets. This diversity in market dynamics keeps competition fierce, prompting key players to continually refine their strategies to stay ahead.

Recent Development

Recent developments in 2023 underscore the industry's responsiveness to evolving consumer trends. The incorporation of functional ingredients, such as adaptogens and superfoods, into Kombucha formulations gained momentum. Key players swiftly adapted, introducing new product lines to meet the demand for beverages that offer both refreshment and health benefits. This trend aligns with the broader consumer shift towards wellness and holistic health.

In terms of market consolidation, there were strategic acquisitions aimed at broadening product portfolios. Larger companies sought to acquire niche players with unique offerings, capitalizing on their strengths to enhance overall market competitiveness. This trend is indicative of the industry's recognition of the importance of diverse product offerings to cater to a wide range of consumer preferences.

Moreover, sustainability emerged as a pivotal factor influencing consumer choices and, consequently, competitive strategies. Companies increasingly focused on eco-friendly packaging and sourcing practices, aligning with the growing environmental consciousness among consumers. Sustainable practices not only resonate with consumers but also contribute to a positive brand image, a crucial element in a market where consumer trust is paramount.