Growing Interest in IoT Applications

The rise of Internet of Things (IoT) applications is emerging as a key driver for the Ka-Band Satellite Equipment Market. As IoT devices proliferate across various sectors, including agriculture, transportation, and smart cities, the need for reliable satellite connectivity becomes increasingly critical. Ka-Band technology offers the necessary bandwidth and low latency required for effective IoT communication. Recent projections indicate that the number of connected IoT devices could exceed 30 billion by 2030, highlighting the potential for growth within the Ka-Band Satellite Equipment Market. This trend underscores the importance of developing robust satellite solutions to support the expanding IoT ecosystem.

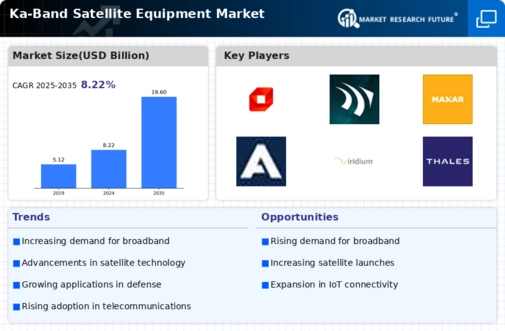

Increased Demand for High-Speed Connectivity

The Ka-Band Satellite Equipment Market is experiencing a surge in demand for high-speed internet connectivity. This demand is driven by the growing reliance on digital services across various sectors, including telecommunications, media, and education. As more consumers and businesses seek reliable and fast internet access, the need for advanced satellite equipment becomes apparent. According to recent data, the demand for broadband services is projected to grow at a compound annual growth rate of over 10% in the coming years. This trend indicates that the Ka-Band Satellite Equipment Market is well-positioned to capitalize on the increasing need for high-speed connectivity, particularly in remote and underserved regions where traditional infrastructure is lacking.

Expansion of Satellite Communication Services

The Ka-Band Satellite Equipment Market is poised for growth due to the expansion of satellite communication services. As industries such as aviation, maritime, and defense increasingly adopt satellite technology for communication, the demand for Ka-Band equipment is likely to rise. The versatility of Ka-Band frequencies allows for higher data rates and improved bandwidth efficiency, making it an attractive option for service providers. Recent statistics suggest that the satellite communication market is expected to reach a valuation of over 100 billion dollars by 2026, indicating a robust growth trajectory. This expansion presents significant opportunities for stakeholders within the Ka-Band Satellite Equipment Market to innovate and enhance their offerings.

Government Investments in Satellite Infrastructure

Government investments in satellite infrastructure are significantly influencing the Ka-Band Satellite Equipment Market. Many governments are recognizing the strategic importance of satellite technology for national security, disaster management, and economic development. As a result, there has been a notable increase in funding for satellite projects, which in turn drives demand for Ka-Band equipment. For instance, several countries are launching new satellites to enhance their communication capabilities, which is expected to create a favorable environment for the Ka-Band Satellite Equipment Market. This trend suggests that public sector initiatives could play a crucial role in shaping the future landscape of satellite communications.

Rising Demand for Remote Education and Telehealth Services

The Ka-Band Satellite Equipment Market is benefiting from the rising demand for remote education and telehealth services. As educational institutions and healthcare providers increasingly turn to digital platforms, the need for reliable satellite connectivity has become paramount. Ka-Band technology provides the necessary bandwidth to support high-quality video conferencing and online learning tools, which are essential for effective remote education. Similarly, telehealth services require stable and fast internet connections to facilitate virtual consultations. Recent data suggests that the telehealth market is projected to grow significantly, potentially reaching over 250 billion dollars by 2028. This growth indicates a strong opportunity for the Ka-Band Satellite Equipment Market to meet the evolving needs of these sectors.

Leave a Comment