Rising Surgical Procedures

The increasing number of surgical procedures in Japan is a primary driver for the surgical site-infection-control market. As the population ages, the demand for surgeries, including orthopedic, cardiovascular, and general surgeries, continues to rise. In 2025, it is estimated that over 10 million surgical procedures will be performed annually in Japan. This surge necessitates robust infection control measures to mitigate the risk of surgical site infections (SSIs). Hospitals and surgical centers are investing in advanced sterilization techniques and infection prevention protocols to ensure patient safety. Consequently, the surgical site-infection-control market is likely to experience significant growth as healthcare facilities prioritize infection control to enhance surgical outcomes and reduce healthcare costs associated with SSIs.

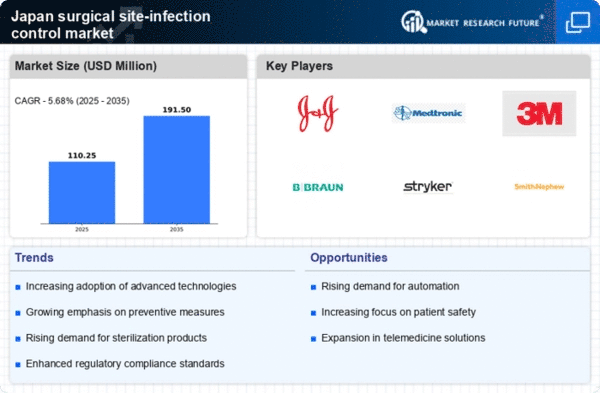

Increased Regulatory Compliance

Increased regulatory compliance requirements in Japan are driving the market. Regulatory bodies are implementing stricter guidelines for infection prevention in surgical settings, necessitating that healthcare facilities adhere to best practices. In 2025, compliance with these regulations is expected to be a key focus for hospitals, with potential penalties for non-compliance. This regulatory landscape compels healthcare providers to invest in comprehensive infection control programs, including staff training and the adoption of new technologies. As a result, the surgical site-infection-control market is likely to expand as facilities strive to meet regulatory standards and enhance patient safety.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare quality and patient safety are significantly influencing the surgical site-infection-control market. The Japanese government has implemented various programs to promote infection control practices in healthcare settings. For instance, funding for research and development of new infection control technologies has increased, with allocations reaching approximately $50 million in 2025. These initiatives encourage hospitals to adopt best practices and invest in advanced infection control solutions. Furthermore, public health campaigns aimed at educating healthcare professionals about the importance of infection prevention are likely to enhance compliance with established protocols, thereby driving the demand for surgical site-infection-control products and services.

Growing Awareness of Patient Safety

There is a growing awareness of patient safety among healthcare providers and patients in Japan, which is driving the surgical site-infection-control market. As patients become more informed about the risks associated with surgical procedures, they increasingly demand higher standards of care. This shift in patient expectations compels healthcare facilities to implement stringent infection control measures. Surveys indicate that over 70% of patients consider infection rates when choosing a surgical facility. Consequently, hospitals are investing in comprehensive infection prevention programs, including the use of antimicrobial agents and advanced surgical techniques. This heightened focus on patient safety is likely to propel the surgical site-infection-control market as facilities strive to meet patient demands and regulatory standards.

Technological Advancements in Infection Control

Technological advancements in infection control are reshaping the surgical site-infection-control market. Innovations such as antimicrobial coatings, advanced sterilization equipment, and real-time monitoring systems are becoming increasingly prevalent in surgical settings. In 2025, the market for advanced sterilization technologies is projected to reach $1 billion in Japan. These technologies not only enhance the effectiveness of infection control measures but also streamline surgical workflows. As healthcare providers seek to improve surgical outcomes and reduce SSIs, the adoption of these advanced technologies is likely to accelerate. The surgical site-infection-control market stands to benefit from this trend as hospitals invest in cutting-edge solutions to enhance patient safety and operational efficiency.