Aging Population and Urbanization

Japan's demographic challenges, particularly its aging population, are significantly influencing the smart government market. With over 28% of the population aged 65 and older, there is an urgent need for innovative solutions to support elderly citizens. Smart healthcare systems, including telemedicine and remote monitoring, are being developed to address these needs. Additionally, urbanization trends, with over 91% of the population living in urban areas, necessitate the implementation of smart city initiatives to manage resources effectively. The government is investing heavily in these areas, with projections indicating that the smart healthcare market alone could reach $10 billion by 2026. This demographic shift is driving the demand for smart solutions that enhance the quality of life for citizens, thereby propelling the growth of the smart government market.

Government Policy and Regulatory Support

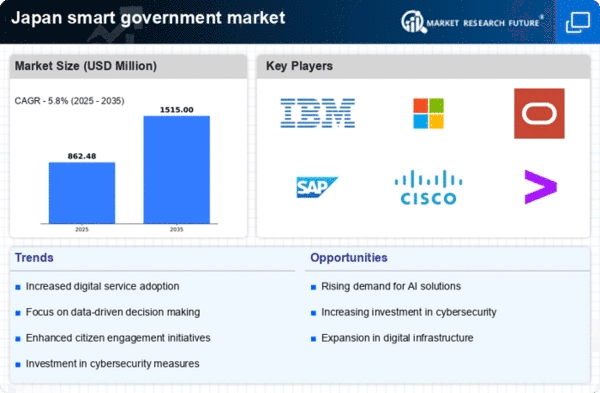

The Japanese government plays a crucial role in shaping the smart government market through supportive policies and regulations. Initiatives such as the 'Smart City Development Strategy' aim to promote the integration of advanced technologies in urban planning and public services. The government has set ambitious targets, including a 50% reduction in greenhouse gas emissions by 2030, which necessitates the adoption of smart technologies. Furthermore, the establishment of regulatory frameworks encourages public-private partnerships, facilitating innovation and investment in the smart government market. As a result, the market is projected to grow at a CAGR of 15% over the next five years, driven by these favorable policies. This proactive approach by the government is likely to create a conducive environment for the development and implementation of smart solutions across various sectors.

Economic Growth and Investment in Innovation

Japan's robust economic growth is a significant driver of the smart government market. The government has recognized the importance of innovation in maintaining competitiveness and is actively investing in research and development. In 2025, the government allocated approximately $2 billion to support smart technology initiatives across various sectors, including transportation, healthcare, and public safety. This investment is expected to stimulate the growth of the smart government market, as it encourages the adoption of cutting-edge technologies. Additionally, the focus on innovation aligns with Japan's long-term economic strategy, which aims to enhance productivity and efficiency in public services. As a result, the smart government market is poised for substantial growth, driven by increased investment in innovative solutions that address the evolving needs of society.

Technological Advancements in Infrastructure

The rapid evolution of technology is a primary driver for the smart government market in Japan. Innovations in IoT, AI, and big data analytics are transforming public services, enhancing efficiency and responsiveness. For instance, the integration of smart sensors in urban infrastructure allows for real-time monitoring of traffic and environmental conditions. This technological shift is expected to increase operational efficiency by up to 30% in various government sectors. Furthermore, the Japanese government has allocated approximately $1 billion to support the development of smart city projects, indicating a strong commitment to leveraging technology for improved public service delivery. As these advancements continue to unfold, they are likely to reshape the landscape of the smart government market, fostering a more connected and efficient governance framework.

Increased Citizen Engagement and Transparency

The demand for greater transparency and citizen engagement is reshaping the smart government market in Japan. Citizens are increasingly seeking more accessible and participatory governance, prompting governments to adopt digital platforms for communication and service delivery. Initiatives such as e-governance and open data policies are being implemented to enhance transparency and foster trust between citizens and government entities. According to recent surveys, over 70% of citizens express a desire for more digital interaction with their local governments. This shift towards digital engagement is expected to drive the smart government market, as governments invest in technologies that facilitate real-time communication and feedback mechanisms. By prioritizing citizen engagement, the smart government market is likely to evolve, leading to more responsive and accountable governance.